Creating a monthly budget is a crucial step in managing personal finances effectively. It helps individuals track their income and expenses, set financial goals, and make informed decisions about spending and saving. A well-designed budget plan can lead to improved financial stability, reduced stress, and increased opportunities for long-term financial growth.

This step-by-step guide will walk readers through the process of creating a monthly budget that works. It covers calculating monthly income, tracking expenses, setting financial goals, and choosing a budgeting method. The article also provides guidance on creating a budget plan, monitoring progress, and making necessary adjustments to ensure long-term success in financial planning.

Calculate Your Monthly Income

The first step in creating a monthly budget is to calculate one’s monthly income. This involves determining the total amount of money an individual receives regularly. By understanding their income, individuals can make informed decisions about their spending and saving habits.

Take-home pay

Take-home pay, also known as net income, is the amount of money an individual receives after all deductions have been made from their gross salary. These deductions typically include income tax, employee contributions to provident funds, and professional tax. To calculate take-home pay, individuals can use the following formula:

Take-Home Salary = Gross Salary – Deductions (Income Tax + Employees PF Contribution + Professional Tax)

Understanding take-home pay is crucial for budgeting as it represents the actual amount available for expenses and savings. Many employers provide detailed pay stubs that break down gross salary and deductions, making it easier to determine the exact take-home amount.

Additional income sources

While the main source of income for most individuals comes from their full-time or part-time job in the form of salaries or wages, it’s important to consider additional income sources when creating a budget. These may include:

Including these additional income sources in the budget calculation provides a more comprehensive view of one’s financial situation and allows for better planning and allocation of resources.

Irregular income considerations

For individuals with irregular income, such as those who work on commission or have seasonal employment, budgeting can be more challenging. Here are some strategies to handle irregular income:

By carefully calculating monthly income, including all sources, and considering the unique challenges of irregular income, individuals can create a solid foundation for their budget plan. This understanding of income forms the basis for making informed decisions about expenses, savings, and financial goals.

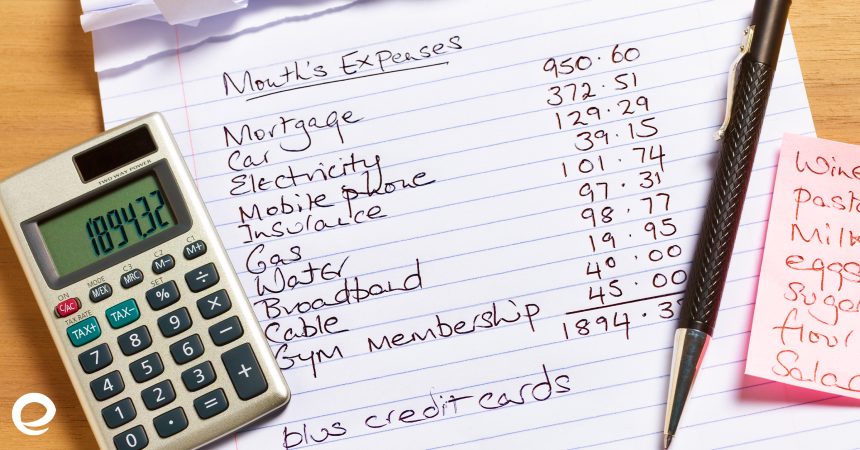

Track Your Monthly Expenses

Tracking monthly expenses is a crucial step in creating an effective budget plan. By understanding where money is being spent, individuals can make informed decisions about their financial planning and identify areas for potential savings.

Fixed expenses

Fixed expenses are costs that remain relatively constant from month to month and are necessary for maintaining one’s standard of living. These expenses are predictable, making it easier to budget for them since the exact amount needed to set aside each month is known. Examples of fixed expenses include:

• Rent or mortgage payments • Insurance premiums (health, home, auto, life) • Car loan payments • Subscription services

When budgeting for housing costs, it’s important to include not only the rent or mortgage payment but also other related expenses such as property taxes, household repairs, and homeowners association (HOA) fees.

Variable expenses

Variable expenses fluctuate from month to month and are often discretionary in nature. These costs can be more challenging to predict, but individuals can average out the total cost of these expenses for the year and allocate that total across 12 months. Examples of variable expenses include:

• Groceries • Utilities (electricity, water, gas) • Entertainment • Dining out • Clothing • Transportation costs (gas, public transit fares)

It’s important to note that variable expenses increase or decrease depending on a company’s production or sales volume—they rise as production increases and fall as production decreases. While this concept applies more to businesses, individuals can also experience fluctuations in their variable expenses based on their lifestyle and consumption patterns.

Hidden costs to watch for

When creating a budget plan, it’s essential to be aware of hidden costs that are often overlooked. These expenses can significantly impact one’s financial planning if not accounted for properly. Some commonly forgotten expenses include:

By accounting for these hidden costs, individuals can create a more accurate and comprehensive budget plan, helping them avoid unexpected financial strain and better manage their monthly expenses.

Set Financial Goals

Setting financial goals is a crucial step in creating an effective monthly budget plan. By establishing clear objectives, individuals can align their spending habits with their long-term aspirations and make informed decisions about their finances.

Short-term goals

Short-term financial goals are objectives that can be achieved within a year or less. These goals are typically low-risk and require careful budgeting of income and expenses. Some examples of short-term goals include:

• Buying a new phone • Saving for a trip • Paying off a small amount of debt

To reach these goals, individuals should allocate a portion of their income to a safe and accessible place, such as a bank account or a money jar. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, people can track their progress and stay motivated.

Long-term goals

Long-term financial goals are objectives that typically take more than five years to achieve. These goals often involve significant financial commitments and may require a more comprehensive approach to financial planning. Examples of long-term goals include:

• Saving for a down payment on a house • Funding retirement • Paying off large debts (e.g., student loans, mortgage) • Saving for a child’s college education

To work towards long-term goals, individuals should project their income and expenses and invest a portion of their money in growth-oriented and long-lasting ways, such as stocks or bonds. It’s important to set target dates for reaching these goals and establish intermediary milestones to stay on track.

Emergency fund

An emergency fund is a crucial component of any financial plan, serving as a safety net for unexpected expenses or financial setbacks. Building an emergency fund should be a top priority when setting financial goals, as it provides stability and peace of mind.

To create an effective emergency fund:

By incorporating these financial goals into your monthly budget plan, you can create a solid foundation for your financial future. Remember to regularly review and adjust your goals as your circumstances change, and consider working with a financial advisor to gain valuable insights and strategies for achieving your objectives.

Choose a Budgeting Method

Selecting an appropriate budgeting method is crucial for effective financial planning. There are several approaches to creating a monthly budget plan, each with its own advantages. Let’s explore three popular budgeting methods that can help individuals manage their income and expenses more efficiently.

50/30/20 rule

The 50/30/20 rule is a straightforward budgeting method that divides after-tax income into three main categories. According to this approach, 50% of income should be allocated to needs, 30% to wants, and 20% to savings and debt repayment. This method simplifies the process of budgeting and helps individuals prioritize their expenses.

Needs typically include essential expenses such as housing, utilities, groceries, and transportation. Wants encompass discretionary spending on entertainment, dining out, and non-essential purchases. The remaining 20% is dedicated to savings, investments, and debt reduction.

One of the advantages of the 50/30/20 rule is its flexibility. If an individual’s circumstances change, they can adjust the percentages to better suit their financial situation. For example, someone with significant debt might allocate more than 20% towards debt repayment until their financial obligations are under control.

Zero-based budgeting

Zero-based budgeting (ZBB) is a more detailed approach to financial planning. This method requires individuals to justify every expense from scratch, starting with a “zero base”. Unlike traditional budgeting methods that rely on previous spending patterns, ZBB encourages a fresh evaluation of all expenses during each budgeting cycle.

The primary goal of zero-based budgeting is to optimize resource allocation by ensuring that funds are directed towards activities that align with financial goals and generate the highest value. This approach can be particularly effective for identifying unnecessary costs and promoting a more focused use of resources.

While zero-based budgeting can be time-consuming, especially during the initial implementation, it offers several benefits. It promotes cost savings, enhances efficiency, and increases accountability in financial decision-making. By scrutinizing each expense category, individuals gain a clearer understanding of their spending habits and can make more informed choices about resource allocation.

Envelope system

The envelope system, also known as cash stuffing, is a tangible approach to budgeting that involves using physical envelopes to manage discretionary spending. This method is particularly useful for individuals who struggle with overspending in certain categories.

To implement the envelope system, individuals allocate a specific amount of cash to different spending categories, such as groceries, entertainment, and personal care. The designated amount for each category is placed in a labeled envelope. Once the cash in an envelope is depleted, no more spending is allowed in that category until the next budgeting period.

This hands-on approach to budgeting can be highly effective in controlling spending and promoting more intentional financial decisions. It provides a visual representation of available funds and helps individuals stick to their budget plan. However, it’s important to note that the envelope system works best for variable expenses and may require some adjustments for online purchases or fixed costs.

By choosing a budgeting method that aligns with their financial goals and personal preferences, individuals can take control of their finances and work towards a more stable financial future.

Create Your Budget Plan

Creating an effective budget plan is a crucial step in managing personal finances. By allocating funds wisely and prioritizing expenses, individuals can achieve their financial goals and maintain financial stability.

Allocate funds to expense categories

When creating a budget plan, it’s essential to allocate funds to various expense categories. The 50/30/20 rule is a popular budgeting method that can serve as a helpful guideline. According to this approach, 50% of after-tax income should be allocated to needs, 30% to wants, and 20% to savings and debt repayment.

Needs typically include essential expenses such as housing, utilities, groceries, and transportation. Wants encompass discretionary spending on entertainment, dining out, and non-essential purchases. The remaining 20% is dedicated to savings, investments, and debt reduction.

When allocating funds, it’s important to consider both fixed and variable expenses. Fixed expenses, such as rent or mortgage payments, insurance premiums, and loan payments, remain relatively constant from month to month. Variable expenses, like groceries, utilities, and entertainment, can fluctuate based on usage and lifestyle choices.

Prioritize savings and debt repayment

A crucial aspect of creating a budget plan is prioritizing savings and debt repayment. Building an emergency fund should be a top priority, as it provides a financial safety net for unexpected expenses or income disruptions. Aim to save at least three months’ worth of living expenses in an easily accessible account.

For debt repayment, consider using either the debt avalanche or debt snowball method. The debt avalanche method involves paying off debts with the highest interest rates first, potentially saving money on interest over time. The debt snowball method focuses on paying off the smallest debts first, which can provide quick wins and motivation to continue paying off debt.

Leave room for flexibility

While it’s important to have a structured budget plan, leaving room for flexibility is equally crucial. Life circumstances and financial situations can change, so it’s essential to review and adjust your budget regularly.

One way to incorporate flexibility is by using a zero-based budgeting approach. This method involves allocating every dollar of income to a specific purpose, including savings and debt repayment. By giving each dollar a job, individuals can make more informed decisions about their spending and adjust allocations as needed.

Another strategy to enhance flexibility is to set up automatic deposits and payments. This can help ensure that essential expenses are covered and savings goals are met while allowing for adjustments in discretionary spending categories.

By creating a well-structured budget plan that allocates funds effectively, prioritizes savings and debt repayment, and allows for flexibility, individuals can take control of their finances and work towards their long-term financial goals. Regular review and adjustment of the budget will help ensure its continued effectiveness in supporting financial planning and stability.

Monitor and Adjust Your Budget

Creating a budget plan is just the first step in managing personal finances. To ensure long-term financial success, it’s crucial to monitor and adjust your budget regularly. This process helps individuals stay on track with their financial goals and adapt to changing circumstances.

Track spending regularly

Tracking expenses is a fundamental aspect of maintaining a healthy financial life. It provides an accurate picture of where money is going and helps identify areas where adjustments may be necessary. Research shows that while 93% of Americans believe maintaining a personal budget is important, only 33% actually do so.

To effectively track spending, consider using expense tracker apps. These tools categorize expenses and provide insights into purchasing behavior. Some apps automatically sync with bank accounts and credit cards, saving time and effort. By consistently monitoring expenses, individuals can ensure they’re living below their means, which is key to a sustainable budget.

Review and revise monthly

Monthly budget reviews are essential for staying on top of finances. At the end of each month, individuals should assess their progress towards financial goals and identify any areas where they may have overspent. This review process allows for timely adjustments and helps maintain financial stability.

During these monthly reviews, it’s important to:

• Evaluate progress towards financial goals • Identify categories where overspending occurred • Assess the need for budget adjustments • Reprioritize targets based on life changes

For smaller overages, consider reviewing variable expenses such as streaming services, subscriptions, or memberships. These flexible costs can often be reduced to help stay on track with financial goals.

Celebrate milestones

Acknowledging and celebrating financial milestones, no matter how small, is crucial for maintaining motivation and commitment to long-term goals. These celebrations reinforce positive financial behaviors and help combat feelings of financial overwhelm.

When celebrating financial milestones:

• Set achievable, specific, and time-bound goals • Break larger financial ambitions into smaller, measurable steps • Use visual trackers to monitor progress • Consider budget-friendly ways to reward yourself, such as experiences or investments in personal growth

By incorporating regular expense tracking, monthly reviews, and milestone celebrations into their financial routine, individuals can maintain a dynamic and effective budget plan. This approach allows for continuous improvement and adaptation to changing financial circumstances, ultimately leading to greater financial stability and success.

Conclusion

Creating a monthly budget that works is a powerful tool to take control of your finances and achieve your goals. By following the steps outlined in this guide, you can gain a clear picture of your income and expenses, set meaningful financial targets, and choose a budgeting method that suits your lifestyle. The key is to start small, be consistent, and stay flexible as you work towards financial stability.

Remember that budgeting is an ongoing process that requires regular monitoring and adjustments. As you track your spending, review your progress, and celebrate milestones along the way, you’ll develop better financial habits and make smarter money decisions. With patience and persistence, your budget will become a roadmap to help you navigate your financial journey and build a more secure future.

FAQs

- How can I create a monthly budget from scratch? To develop a monthly budget, follow these five essential steps: First, estimate your monthly income. Second, determine your monthly expenses. Third, compare your total estimated income with your expenses, and consider your priorities and financial goals. Fourth, monitor your spending throughout the month to ensure it aligns with your planned budget.

- What are the key steps to formulating a budget? Creating a budget involves seven critical steps: Begin by setting realistic goals. Next, identify your income and expenses. Distinguish between your needs and wants. Design your budget plan. Implement your budget. Account for seasonal expenses. Finally, plan for the future.

- What does the 50/30/20 budget rule entail? The 50/30/20 rule, popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan,” is a budgeting framework that divides after-tax income into three spending categories: 50% for necessities, 30% for wants, and 20% for savings.

- Can you outline the five steps to crafting an effective budget? To craft an effective budget, start by calculating your net income. List all your monthly expenses. Label each expense as either fixed or variable. Calculate the average monthly cost for each type of expense. Finally, make necessary adjustments to ensure your spending aligns with your financial goals.