Cryptocurrency tax laws have become a crucial aspect of financial regulation as digital assets gain widespread adoption. As governments worldwide grapple with this new form of wealth, individuals and businesses must navigate complex tax implications. Understanding these laws is essential for crypto tax compliance and accurate income tax reporting.

This comprehensive guide explores cryptocurrency taxation in India, covering taxable transactions and calculation methods. It delves into the specifics of TDS on crypto transactions and provides insights on reporting cryptocurrency on tax returns. By the end, readers will have a clearer understanding of their obligations when it comes to crypto tax and ITR filing in 2024.

Understanding Cryptocurrency Taxation in India

The Indian government has taken significant steps to address the taxation of cryptocurrencies and other virtual digital assets (VDAs). As these digital assets gain popularity, it has become crucial to establish a clear framework for their taxation. The Finance Act of 2022 introduced new provisions that have a substantial impact on cryptocurrency investors and traders in India.

Definition of Virtual Digital Assets

The Income Tax Act now includes a comprehensive definition of Virtual Digital Assets (VDAs) under Section 2(47A). This definition encompasses a wide range of digital assets, including cryptocurrencies, non-fungible tokens (NFTs), and other tokens. According to the Act, a VDA refers to any information, code, number, or token generated through cryptographic means or otherwise, which provides a digital representation of value. These assets can be exchanged with or without consideration and may function as a store of value or a unit of account. The definition also covers their use in financial transactions or investment schemes.

30% Tax on Crypto Gains

One of the most significant aspects of the new cryptocurrency tax laws is the introduction of a 30% tax on income from VDAs. This tax rate applies to profits made from trading, selling, or spending cryptocurrencies, regardless of whether the gains are considered investment income or business income. The government has not made any distinction between short-term and long-term gains, treating all profits from VDAs equally.

It’s important to note that this 30% tax is applicable on the gains, not the entire transaction amount. However, the tax regulations are quite strict in this regard. No deductions for expenditures or allowances are permitted while computing this income, except for the cost of acquisition. This means that expenses related to trading or maintaining cryptocurrency investments cannot be used to offset the taxable gains.

1% TDS on Crypto Transactions

To ensure better tracking and monitoring of cryptocurrency transactions, the government has implemented a 1% Tax Deducted at Source (TDS) on the transfer of VDAs. This provision, outlined in Section 194S of the Income Tax Act, came into effect on July 1, 2022.

The 1% TDS applies to transactions exceeding Rs 50,000 in a fiscal year, or Rs 10,000 in certain cases. This tax is deducted at the time of payment or credit, whichever is earlier. The responsibility for deducting and depositing the TDS lies with the buyer or the exchange facilitating the transaction.

For transactions on Indian cryptocurrency exchanges, the platforms automatically deduct the TDS and deposit it with the government. However, for peer-to-peer transactions or trades on international exchanges, the buyer is responsible for deducting and paying the TDS.

It’s crucial to understand that the TDS is not an additional tax but rather an advance tax collected at the source. Taxpayers can claim credit for this TDS when filing their income tax returns. The primary purpose of this provision is to create a trail of cryptocurrency transactions and ensure compliance with tax laws.

The introduction of these tax provisions marks a significant step in the regulation of cryptocurrencies in India. While it brings more clarity to the taxation of virtual digital assets, it also imposes stricter reporting requirements on investors and traders. As the cryptocurrency landscape continues to evolve, it’s essential for participants in this space to stay informed about their tax obligations and ensure compliance with the latest regulations.

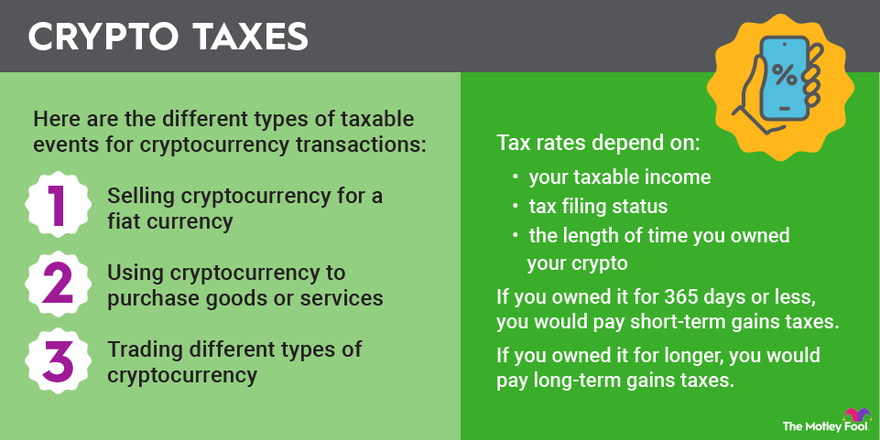

Taxable Cryptocurrency Transactions

Understanding the taxable events in cryptocurrency transactions is crucial for compliance with income tax regulations and proper ITR filing. In India, various crypto-related activities are subject to taxation, and it’s essential to be aware of these to ensure crypto tax compliance.

Trading and Selling Crypto

The Indian government has implemented a flat tax rate of 30% on gains from trading, selling, or swapping cryptocurrencies. This tax applies to all profits, regardless of whether they are considered investment income or business income. It’s important to note that there is no distinction between short-term and long-term gains when it comes to cryptocurrency taxation.

When an individual or a corporate entity sells virtual digital assets (VDAs) in exchange for traditional currency, the profits derived from the transaction are subject to the 30% tax rate, plus applicable surcharge and education cess. Similarly, if one participates in the exchange of one type of VDA for another or enters into a swap arrangement, the resulting profits are taxed at the same rate.

One significant aspect of cryptocurrency tax laws is that no deductions for expenditures or allowances are permitted while computing this income, except for the cost of acquisition. This means that expenses related to trading or maintaining cryptocurrency investments cannot be used to offset the taxable gains. Additionally, losses from cryptocurrency transactions cannot be set off against profits or carried forward to future tax assessment years.

Using Crypto for Purchases

When cryptocurrencies are used to purchase goods or services, it triggers a taxable event. This transaction is categorized as a form of VDA disposal and is subject to capital gains tax. Individuals must pay a 30% tax on any profit made from spending cryptocurrency, along with a 4% health and education cess on the capital gains tax amount.

For example, if someone buys a product using Bitcoin, they would need to calculate the difference between the purchase price of the Bitcoin and its value at the time of the transaction. This difference would be subject to the 30% tax rate.

Mining and Staking Rewards

Cryptocurrency mining and staking are also subject to taxation in India. The tax treatment for these activities can vary depending on the scale of the operation and the individual’s intent.

For mining activities, the income generated is taxed based on the fair market value (FMV) of the mined cryptocurrency at the time of receipt. This value is converted to Indian Rupees (INR) to determine the tax liability. The tax authorities may seek to tax such rewards as income from other sources at the rate of 30%, plus applicable surcharge and education cess.

Large-scale mining operations aimed at profit are typically treated as business income, allowing for deductions on expenses such as mining equipment and electricity bills. However, mining undertaken as a hobby falls under the category of Income from Other Sources and is not eligible for such deductions.

Staking, which involves validating transactions and earning rewards by holding and “staking” cryptocurrency, is also subject to taxation. The staking rewards are taxed as income based on their fair market value in INR upon receipt. It’s important to note that income tax is applicable even if the tokens aren’t sold.

When it comes to selling mined or staked cryptocurrency, capital gains tax applies. The tax rate is 30% flat and includes a 4% health and education cess. Interestingly, for mined assets, the cost basis is considered zero, which means the entire sale price is treated as a taxable gain.

Understanding these taxable cryptocurrency transactions is essential for proper crypto tax compliance and accurate ITR filing. As the cryptocurrency landscape continues to evolve, staying informed about the latest tax laws and regulations is crucial for investors and traders in the digital asset space.

Calculating Crypto Taxes

Calculating taxes on cryptocurrency transactions can be complex, but understanding the process is crucial for accurate income tax reporting and crypto tax compliance. In India, the government has implemented specific rules for taxing virtual digital assets (VDAs), including cryptocurrencies.

Determining Cost Basis

The cost basis is the starting point for calculating crypto taxes. It represents the amount paid to acquire the cryptocurrency or its fair market value in Indian Rupees (INR) on the day of receipt. Unlike some other countries, the Income Tax Department (ITD) in India does not allow the inclusion of transaction fees, such as buy or sell fees, in the cost basis calculation.

For Indian crypto investors, determining the cost basis becomes more complicated when dealing with multiple crypto assets. The commonly recognized methods for calculating cost basis include:

Computing Capital Gains

To compute capital gains on cryptocurrency transactions, investors need to subtract the cost basis from the sale price or fair market value at the time of disposal. The Indian government has implemented a flat tax rate of 30% on gains from trading, selling, or swapping cryptocurrencies.

For sales, the calculation is straightforward: subtract the cost basis from the sale price in INR. However, for other disposals, such as trading or spending crypto, investors must subtract the cost basis from the fair market value in INR on the day of disposal.

It’s important to note that under Section 115BBH, crypto-related expenses (such as transaction fees) cannot be claimed as deductions. The only allowable deduction is the cost of acquisition, which is the original purchase price of the asset.

Offsetting Losses

Unfortunately for Indian crypto investors, the news isn’t favorable when it comes to offsetting losses. Section 115BBH prohibits offsetting crypto losses against crypto gains or any other income. This means that if an investor incurs a loss on one crypto asset, they cannot use it to reduce their tax liability from profits on another.

Additionally, losses from cryptocurrency transactions cannot be carried forward to future tax assessment years. This strict approach to crypto taxation in India emphasizes the importance of careful planning and record-keeping for investors.

To ensure accurate crypto tax compliance and proper ITR filing, investors should maintain detailed records of all their cryptocurrency transactions. This includes purchase dates, sale dates, amounts involved, and the fair market value of the assets at the time of each transaction.

As cryptocurrency taxation continues to evolve, staying informed about the latest regulations and seeking professional advice when needed can help investors navigate the complexities of crypto tax laws. By understanding the nuances of calculating crypto taxes, determining cost basis, computing capital gains, and the limitations on offsetting losses, investors can better prepare for their tax obligations in the rapidly changing landscape of digital assets.

TDS on Cryptocurrency Transactions

The implementation of Tax Deducted at Source (TDS) on cryptocurrency transactions marks a significant development in India’s approach to regulating and taxing virtual digital assets (VDAs). This measure, introduced through Section 194S of the Income Tax Act, aims to enhance compliance and streamline the taxation process for cryptocurrency-related activities.

When TDS Applies

TDS on cryptocurrency transactions came into effect on July 1, 2022. It applies to the transfer of VDAs, which include cryptocurrencies like Bitcoin, Ethereum, and other digital tokens. The TDS is deducted at the time of payment or credit, whichever is earlier, for transactions involving the sale, exchange, or transfer of cryptocurrencies.

It’s important to note that TDS is applicable even if an individual has already paid the 30% tax on their crypto gains. These two tax liabilities are separate and need to be settled individually. However, if the tax owed is less than the tax deducted, investors can claim the difference as a refund when filing their income tax return.

TDS Thresholds

The government has set specific thresholds for TDS applicability to ensure that small-scale traders and investors are not unduly burdened. For most individuals and entities, TDS is applicable when the aggregate value of cryptocurrency transactions exceeds ₹10,000 in a financial year.

However, for “specified persons,” which include individuals and Hindu Undivided Families (HUFs), the threshold is higher. TDS is not required if the total value of crypto trading activities does not exceed ₹50,000 in a financial year. This higher threshold provides some relief for smaller investors and casual traders.

TDS Compliance for Exchanges and P2P Trades

The responsibility for TDS compliance varies depending on the nature of the transaction:

To ensure compliance, individuals and entities involved in cryptocurrency transactions must obtain a Tax Deduction and Collection Account Number (TAN) and file Form 26Q quarterly. TDS payments should be made by the 7th of the month following the deduction.

It’s crucial to note that non-compliance with TDS regulations can result in severe penalties. Failure to deduct TDS may lead to a penalty equal to the TDS amount due. More seriously, deducting TDS but failing to deposit it with the government could result in imprisonment for 3 months to 7 years, along with hefty fines.

As the cryptocurrency landscape continues to evolve, staying informed about TDS regulations and ensuring proper compliance is essential for all participants in the crypto market. By understanding when TDS applies, the relevant thresholds, and the compliance requirements for different types of transactions, investors and traders can navigate the complex world of cryptocurrency taxation more effectively.

Reporting Cryptocurrency on Tax Returns

Reporting cryptocurrency transactions on tax returns has become a crucial aspect of income tax compliance in India. With the introduction of new regulations, taxpayers must accurately disclose their crypto-related activities to avoid potential penalties. The Income Tax Department (ITD) has made it clear that all income earned from cryptocurrencies is taxable under the Income Tax Act.

Schedule VDA in ITR

The Indian government has introduced a dedicated section called Schedule – Virtual Digital Assets (VDA) in the Income Tax Return (ITR) forms for the financial year 2023-2024. This new schedule aims to simplify the process of reporting gains from cryptocurrencies and other virtual digital assets.

For individuals who hold cryptocurrencies as investments, income from these assets should be declared as capital gains. However, those who engage in crypto trading as a business activity must report their earnings as business income. It’s important to note that taxpayers with business income are required to use ITR-3 instead of ITR-2.

The Schedule VDA is inserted in the Capital Gains section of the ITR form. It requires a quarterly breakdown of VDA income, allowing taxpayers to choose between reporting their earnings as capital gains or business income. However, regardless of the reporting method, only the cost of acquisition is allowed to be deducted from the sale price when calculating taxable income.

Disclosing Crypto Assets

When disclosing crypto assets on tax returns, taxpayers must provide detailed information about their transactions. This includes the date of acquisition, date of sale, sale price, and cost of acquisition. For gifted assets, the cost of acquisition must be specified separately.

It’s crucial to understand that losses from cryptocurrency transactions cannot be offset against gains from other VDAs or any other income. This rule, introduced in the Union Budget 2022 and governed by Section 115BBH of the Income Tax Act, applies to all types of crypto assets, including cryptocurrencies and NFTs.

To ensure accurate reporting, taxpayers should create a comprehensive crypto profit and loss (P&L) report. This report will serve as the foundation for populating the ITR schedules. Given the complexity of reporting multiple crypto transactions, numerous TDS entries, airdrops, or maximizing tax savings, it’s recommended to use specialized crypto tax calculation tools designed for Indian users.

Record Keeping Requirements

Maintaining detailed records of all cryptocurrency transactions is essential for accurate tax reporting and crypto tax compliance. Taxpayers should keep the following information for each transaction:

It’s advisable to export transaction history regularly, at least every three months, to safeguard against potential loss of information. Before closing any crypto-related accounts, users should export their complete transaction history.

Records should be kept for at least five years from the later of: when the records were prepared or obtained, when transactions were completed, or the year the capital gains tax event occurred. These records must be in English or translatable to English and can be either electronic or paper-based.

By adhering to these reporting and record-keeping requirements, taxpayers can ensure compliance with cryptocurrency tax laws and avoid potential issues with the Income Tax Department. As the regulatory landscape continues to evolve, staying informed and maintaining accurate records will be crucial for navigating the complexities of cryptocurrency taxation in India.

Conclusion

The evolving landscape of cryptocurrency taxation has a significant impact on investors and traders in India. The introduction of a 30% tax on crypto gains, along with the 1% TDS on transactions, brings both clarity and challenges to the crypto market. These regulations aim to enhance compliance and create a trail of digital asset activities, making it crucial for participants to stay informed about their tax obligations.

To wrap up, accurate reporting and record-keeping are key to navigate the complexities of crypto taxation. By understanding the nuances of calculating taxes, determining cost basis, and adhering to TDS requirements, investors can ensure they’re on the right side of the law. As the crypto scene continues to develop, staying up-to-date with the latest regulations and seeking expert advice when needed will be essential to manage crypto-related taxes effectively.

FAQs

- What are the updated cryptocurrency tax regulations for 2024?

In 2024, individuals dealing with cryptocurrencies and other virtual digital assets are required to report their income. Gains from these assets, if part of an investment portfolio, should be declared as capital gains. If the assets are used for trading, they should be reported as business income. - How can one minimize the 30% tax rate on cryptocurrency gains?

To reduce the tax burden to the long-term capital gains tax rate, which is generally lower, you should hold your cryptocurrencies for more than two years. This qualifies the gains as long-term, thus potentially lowering the tax rate compared to short-term capital gains. - How does the 30% tax rate apply to cryptocurrencies received as salary?

According to the income tax guidelines proposed in the 2022 Budget, any income derived from the transfer of cryptocurrency, including those received as salary, is subject to a 30% tax rate. It’s important to note that no deductions other than the cost of acquisition are permitted from the sale price of the cryptocurrency. - Is cryptocurrency legally recognized in India as of 2024?

The legal status of cryptocurrency in India in 2024 continues to be intricate. Although the Reserve Bank of India (RBI) implemented a ban on cryptocurrency transactions in 2018, the Supreme Court overturned this ban in March 2020, enabling banks to offer services to cryptocurrency exchanges.