Raising venture capital represents a major milestone for startups. The numbers tell the story – only 1% of companies secure VC funding annually. Startups need careful planning and strategic preparation to raise venture capital successfully. They must understand what investors want in their potential investments. Founders who want to stand out need to excel at every part of the fundraising process.

This piece guides founders through the venture capital fundraising process step by step. Readers will discover proven strategies to attract investors. The content covers everything in startup preparation, from understanding VC financing stages to creating compelling pitch decks. It also explains how to build strong teams and present market opportunities effectively. Founders will learn about investor research, pitch optimization, and managing due diligence.

Understand the Venture Capital Landscape

Venture capital represents a complex ecosystem where investors, funding stages, and evaluation criteria intertwine. Startups must guide through this network effectively to secure funding and build lasting relationships with their investors. This understanding becomes vital for founders who aim to achieve their funding goals.

Types of VC firms

Venture capital firms specialize in specific areas that match their expertise and investment thesis. These VC funds usually focus on a combination of three main areas: stage, geography, and industry or market. Their specialized approach helps them build deep expertise and add significant value to portfolio companies. Active funds have secured about 20-25% of their capital from domestic sources while foreign investors provide the rest.

Investment stages

Venture capital funding evolves through distinct stages that reflect a company’s maturity and risk profiles:

| Stage | Purpose | Average Funding Range |

|---|---|---|

| Pre-Seed/Seed | Original product development and market research | INR 8.3M – 83.7M |

| Early-Stage (Series A) | Product refinement and market entry | Up to INR 1,005M |

| Growth (Series B/C) | Scaling operations and market expansion | INR 2,345M – 3,518M |

| Late-Stage | Market expansion or pre-IPO preparation | Varies based on company valuation |

What VCs look for

VCs use a detailed process to evaluate their investments. These are the factors they examine:

The VC landscape has changed substantially. Fintech, Healthtech, Enterprise Software, and Retail Tech have become established sectors. Much of VC funding went to four main sectors in 2019: consumer tech, fintech, B2B commerce and tech, and Software/SaaS – about 80% of the total investments.

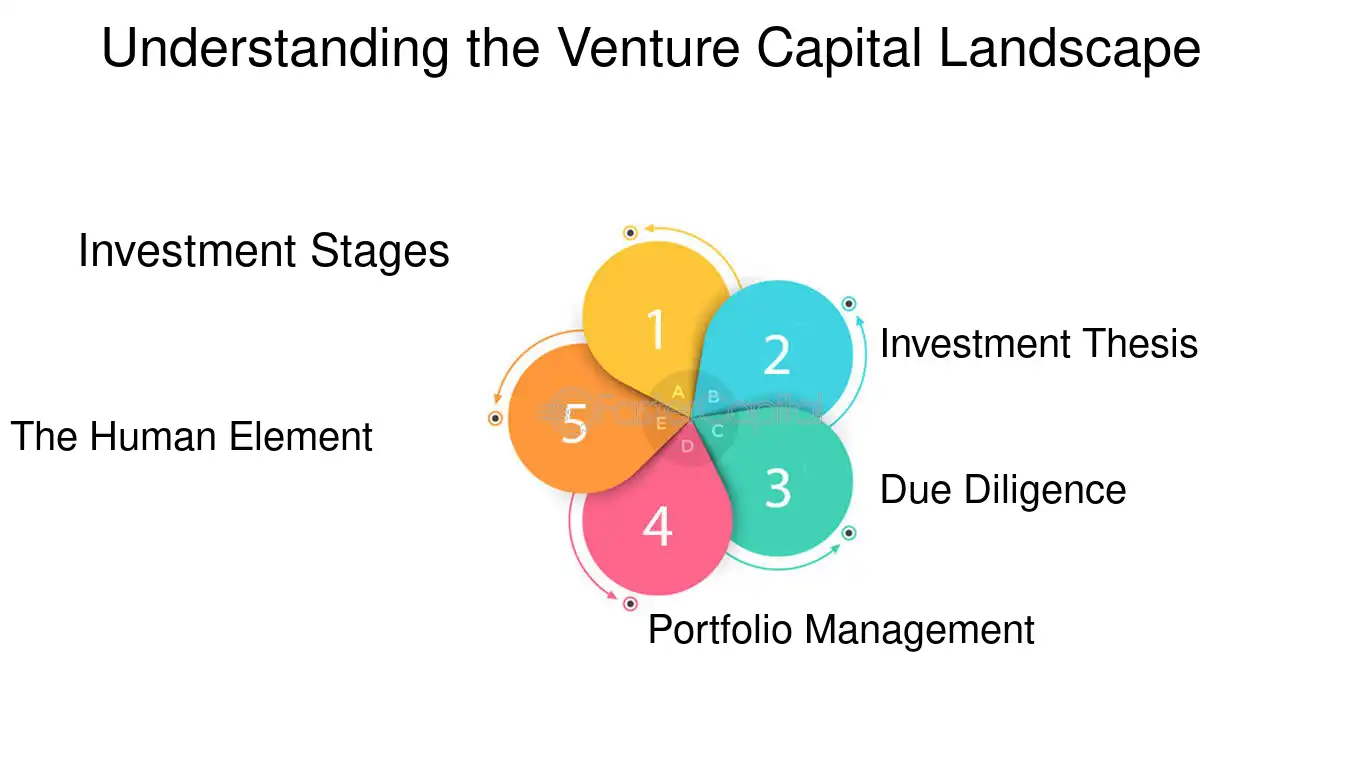

Prepare Your Startup for Fundraising

A startup needs to excel in three crucial areas to attract venture capital funding. The company must create a complete business plan, establish a strong team, and reach substantial milestones. These achievements substantially boost the chances of securing investor funding.

Develop a solid business plan

A compelling business plan serves as the life-blood of raising venture capital. Your plan needs a powerful executive summary that shows investors why your business will succeed. Investors carefully examine these essential components:

Build a strong team

Team composition and quality substantially influence investment decisions. Research shows that investors prefer three founders as the ideal team size. This structure offers:

Entrepreneurs must prove their credibility to solve the identified problem while building their founding team. Investors carefully review teams based on their complementary abilities, industry experience, and proven success record.

Achieve key milestones

Milestones mark significant value-creation points that affect a startup’s valuation. Your achieved milestones show lower risk and higher potential return to investors. These milestones include:

| Category | Example Milestones |

|---|---|

| Product Development | Functional prototype, Beta testing |

| Market Validation | First paying customers, Strategic collaborations |

| Technical Achievement | Patent secured, Product release |

| Financial Performance | Revenue targets, Customer acquisition metrics |

Your startup should prioritize metrics that matter to venture capitalists, such as:

Early-stage startups need to show they can attract and retain users to confirm their business model’s viability. A lean burn rate will strengthen your position in future funding rounds and showcase your financial discipline and resource management skills.

Create a Compelling Pitch Deck

.jpeg)

Your startup’s pitch deck can open doors to venture capital investment. Research shows that investors dedicate [only 3-4 minutes reviewing each pitch deck](https://www.goingvc.com/post/six-different-types-of-vc-firms-you-need-to-know), which makes creating a powerful first impression vital.

Everything in a Pitch Deck

A compelling pitch deck needs [10-20 slides](https://www.vcrazor.com/vc-razor/fund-fit/growth-milestones/) that weave a cohesive story. These key components make your pitch deck stand out:

| Slide Component | Purpose |

|---|---|

| Problem Statement | Define market pain point |

| Solution Overview | Present unique value proposition |

| Market Opportunity | Show growth potential |

| Business Model | Explain revenue streams |

| Competition Analysis | Highlight market advantages |

| Team Background | Showcase expertise |

| Financial Projections | Display growth path |

| Funding Request | Detail capital needs |

Design tips

A professional design substantially affects how investors perceive your company. These design principles will help create an impactful pitch deck:

Research shows that [founders secure funding more often when they showcase their company through well-designed pitch decks](https://www.bfp.vc/venture-capital-in-india-landscape-overview-part-2/).

Tailoring for different audiences

Stakeholders need different emphasis in pitch presentations. The deck customization requires specific approaches:

For Investors:

For Strategic Partners:

For potential clients:

Companies mature and their pitch decks evolve naturally. The content adjusts from seed funding through Series A, B, and C rounds. Smart founders create two versions of their pitch. A concise presentation works best for live pitches. The detailed version with extra commentary helps in follow-up reviews.

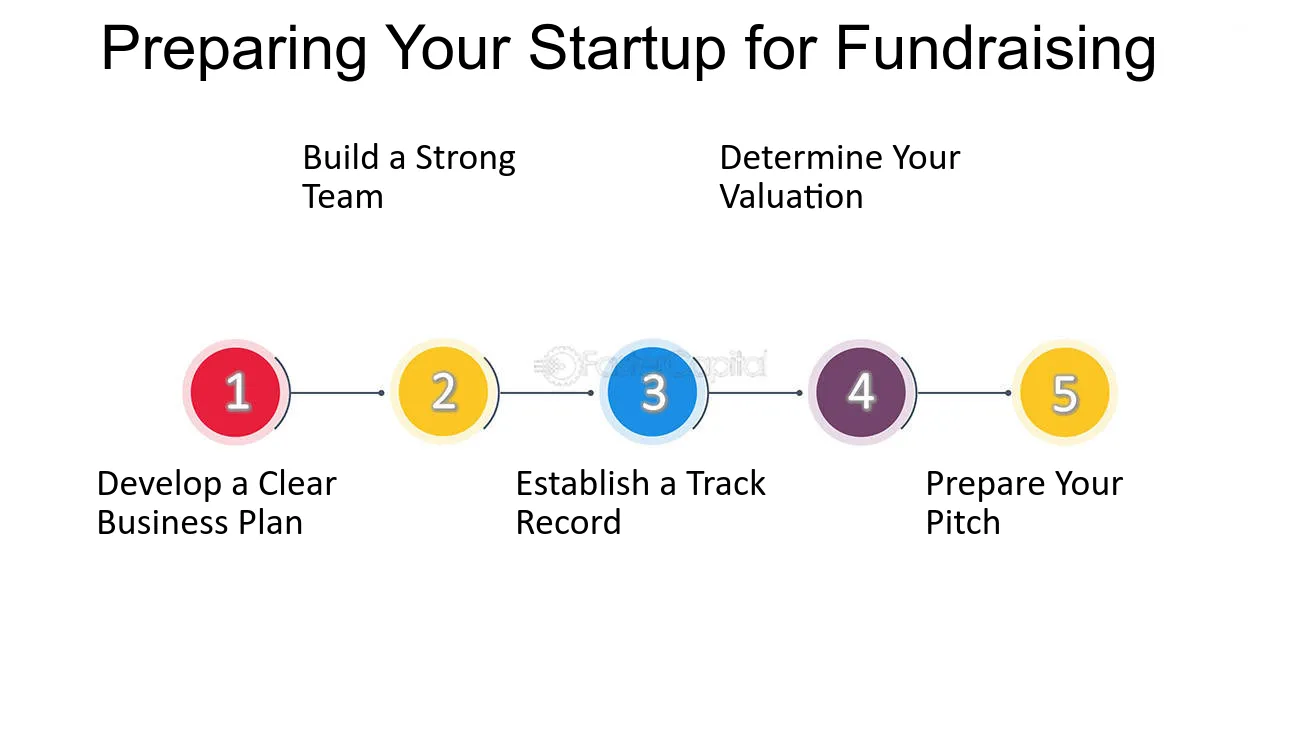

Identify and Research Potential Investors

A smart combination of research and networking helps founders identify and approach potential investors. Research shows that founders must meet with more than 50 investors to close a single funding round. Some founders even connect with over 100 investors during their funding experience.

Creating a target list

A successful investor targeting strategy starts with a detailed list of potential investors. Research indicates founders need an original list of 50-100 prospects which they can narrow down to 15-20 realistic target investors. The list creation process should include these evaluation criteria:

| Criteria | Key Considerations |

|---|---|

| Investment Focus | Industry line up, stage focus |

| Geographic Scope | Location priorities, remote investment policies |

| Portfolio Fit | Similar companies, competitive landscape |

| Fund Status | Active investment period, fund size |

| Value Addition | Network access, strategic support |

Leveraging networks for introductions

Venture capitalists get hundreds of cold inbound requests weekly. A warm introduction plays a significant role to stand out from the crowd. Research shows that introductions from trusted sources increase the chances of securing meetings by a lot. The most effective networking strategies include:

Due diligence on VCs

VCs spend time checking out startups, but founders need to review potential investors too. A typical VC puts in 20 hours or more to check each possible investment. Here’s what founders need to think about:

The due diligence process has three essential stages:

The numbers tell an interesting story. Out of every 100 opportunities that come their way, VCs take a close look at about ten, and end up investing in just one. These odds show why good preparation and targeting the right investors matter so much.

Smart founders break down a VC’s history with their portfolio companies, especially how they act when times get tough. These key areas need attention:

To get the full picture, you can use professional networks, industry databases, and specialized research services that give insights into VC firms and how they invest.

Master the Art of Pitching

.jpeg)

Entrepreneurs must become skilled at pitching to secure venture capital funding. Statistics reveal that investors dedicate [three minutes and 44 seconds to read each deck and 20 minutes to listen to presentations]. Every second matters in this crucial fundraising journey.

Elevator pitch

A startup’s elevator pitch is their first chance to grab investor attention. Research shows that [founders typically have just 60 seconds to sell their idea] at pitch events, random meetings, and networking events. A powerful elevator pitch should include:

| Component | Description |

|---|---|

| Problem Statement | Clear articulation of market pain point |

| Solution Overview | Unique value proposition |

| Market Potential | Size and growth chance |

| Traction Metrics | Key achievements and validation |

| Ask | Specific funding requirements |

Full presentation

A well-structured and carefully delivered investor presentation makes all the difference. Research shows that [investors spend over 15% of their total reading time on the team slide]. This fact underscores the need to showcase leadership capabilities effectively. Successful presentations incorporate these essential principles:

The numbers tell an interesting story – [investors respond to only ~10% of decks and invest in less than 1%]. This statistic proves how crucial it is to make your presentation stand out. Smart entrepreneurs should steer clear of [diving into technical details too quickly or presenting rambling, unfocused content].

Handling Q&A

Your pitch meeting’s success often depends on how well you handle the Q&A session. [Most meetings with venture capitalists function as conversations rather than formal presentations]. This means founders need solid preparation for interactive discussions.

These strategies help you ace the Q&A:

Investors typically zero in on [market validation and customer demand]. You should come prepared with proof that shows your solution fits the market and proves you understand your target audience.

Smart entrepreneurs strike the right balance between confidence and humility when they answer investor questions. Research shows that [investors appreciate founders who can admit what they don’t know]. They prefer honest answers with a promise to follow up later instead of incomplete or wrong information.

End your presentation with a clear next step. Experience shows that [successful founders treat fundraising like sales]. They keep detailed notes of investor meetings and follow up at the right time. Remember that getting investment usually takes several meetings and building strong relationships with potential investors.

Navigate the Due Diligence Process

.jpeg)

The venture capital fundraising process reaches its most rigorous stage during due diligence when investors perform a complete evaluation of the startup’s potential. Research shows that [for every 100 opportunities reviewed, approximately ten receive detailed evaluation, and funds typically invest in just one].

Financial review

Startups must present a complete documentation of their financial health and projections during the financial review process. Investors look at several important metrics:

| Financial Aspect | Key Components | Importance |

|---|---|---|

| Current Financials | Income statements, balance sheets, cash flow | Operational efficiency |

| Burn Rate | Monthly expenses vs. revenue | Sustainability |

| Funding History | Previous rounds, valuations | Growth trajectory |

| Capital Structure | Equity distribution, ownership stakes | Investment effects |

The monthly burn rate calculation plays a vital role when startups seek investment. [If a company spends INR 41,882,852 monthly and generates INR 16,753,140 in revenue, its burn rate would be INR 25,129,711]. This metric helps determine the runway – [with INR 251.30 million in reserves, this example provides a 10-month runway].

Legal and IP review

Intellectual property due diligence serves as the life-blood of investment viability assessment. [This meticulous review reviews the existence and ownership of IP, its enforceability, scope, and potential to stimulate growth and monetization]. The required documentation includes:

The IP review process gets into several critical areas: [ownership verification, freedom to operate analysis, strategic alignment with business goals, and potential licensing opportunities]. Investors can understand the startup’s competitive advantages and potential risks through this review.

Customer and market validation

Customer validation plays a vital role in due diligence. It shows whether a startup’s product or service can succeed in the market. Investors look at:

- Market Fit Indicators

2. Growth Potential

Customer validation proves market demand for the product or service. This helps startups reduce the risk of investing in products that might not fit the market. Startups can figure out their target market’s size and set prices that customers will accept.

Due diligence happens in three main stages:

Venture funds look at hundreds of business opportunities during their fund’s lifetime. They use specific criteria to spot promising investments. This organized approach helps investors spot risks and work with company management to address them.

Startups should prepare well for this process. Ready-to-go due diligence files show investors you’re prepared and speed up their review. The review goes beyond just numbers – it looks at operational risks like execution problems, supply chain issues, and tech failures.

Market risk assessment is another vital part. Investors review risks related to market acceptance, competition, and economic conditions. They analyze how slow adoption rates, changing customer priorities, and competitive pricing pressures might affect the business.

During due diligence, investors carefully check founders and the core team’s background. They contact current and former employees and get third-party audits. These steps give a clear picture of how well the company runs and how effective its leadership is.

Conclusion

Startups need meticulous preparation, strategic execution, and steadfast dedication to secure venture capital funding. A strong foundation starts with detailed business planning, capable teams, and most important milestones before reaching out to investors. The fundraising trip requires you to become skilled at several elements. You must create compelling pitch decks, identify suitable investors, deliver powerful presentations and manage thorough due diligence processes. These components are vital to differentiate your startup from all but one of these companies that fail to secure venture funding.

Venture capital fundraising goes beyond getting capital. It is a vital stepping stone to help startups achieve long-term success and scalability. Founders who take a systematic approach to fundraising have better chances with investors. Market validation, clear growth strategies, and realistic financial projections strengthen their position. Securing venture capital opens a new chapter that needs excellence in execution and strategic growth management. You must build and retain strong relationships with investors who become long-term partners in your startup’s growth story.