Poor financial management causes 82% of business failures. Entrepreneurs must handle both personal and business finances, which creates unique challenges. Their long-term success depends on strategic planning. A well-laid-out financial plan enables business owners to make smart decisions and reach their growth targets.

Business owners need to focus on cash flow management, risk assessment, and tax optimization to achieve financial success. Smart entrepreneurs partner with financial advisors and create complete strategies that balance business growth with personal wealth building. Their resilient financial foundations support both company and personal goals through proper diversification and strategic planning.

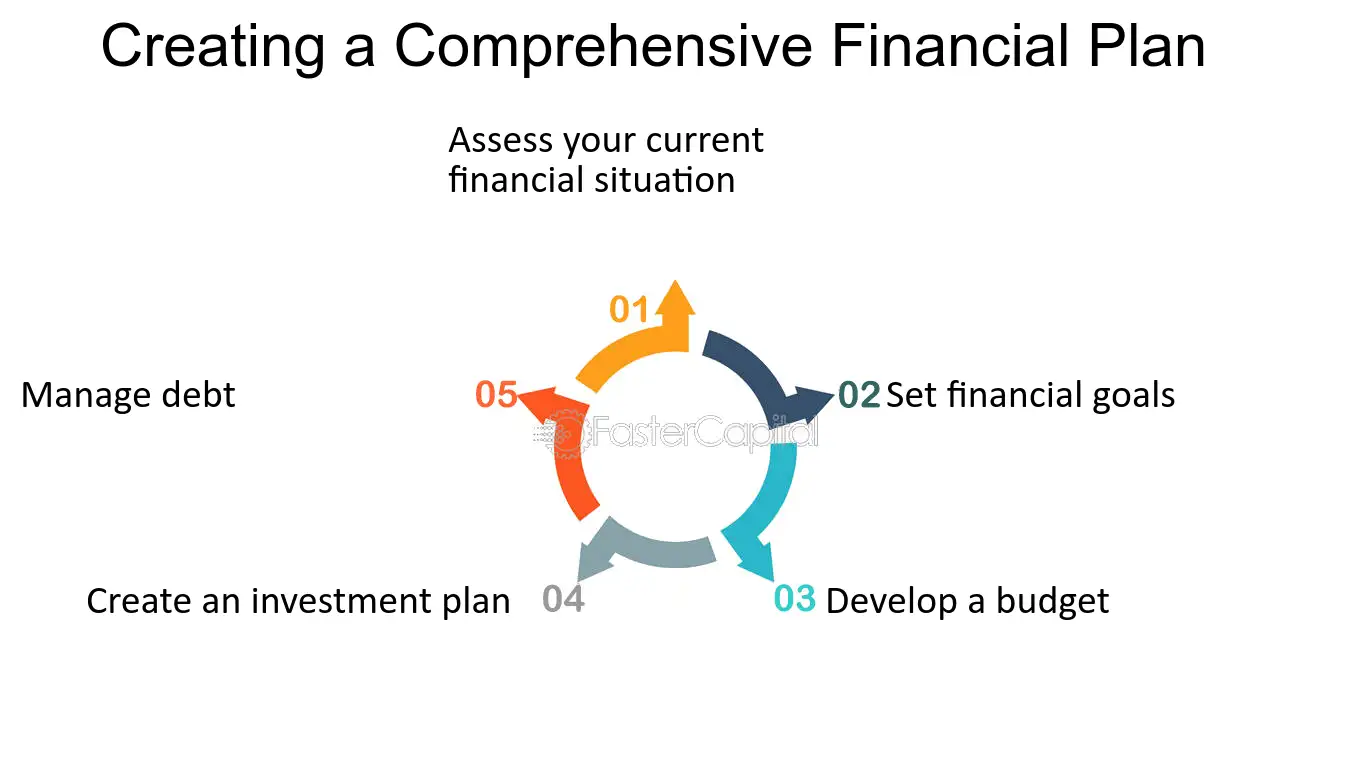

Assess Your Current Financial Situation

A detailed financial assessment creates a strong foundation that helps entrepreneurs plan their finances better. The evaluation looks at three key areas that cover assets, cash flow, and goal setting.

Review Personal and Business Assets

Business assets are the foundations of enterprise value that include both tangible and intangible items. Physical items like vehicles, real estate, and equipment make up tangible assets, while intellectual property and brand value represent intangible assets. The business world classifies these assets into two categories: current assets that convert to cash within one year, and non-current assets that deliver value beyond the one-year mark.

Analyze Cash Flow and Expenses

Cash flow management plays a significant role in business sustainability. Research shows that 82% of small businesses fail due to cash flow problems. A business needs to manage these three types of cash flows effectively:

Business owners should keep their personal and business finances separate to prevent confusion and tax issues. The business stability and growth depend on monitoring income and expenses through detailed cash flow projections regularly.

Identify Financial Goals

SMART framework helps create powerful financial goals that work:

Businesses typically focus on revenue growth percentages, better net profit margins and lower operating costs. To name just one example, many successful companies achieve a net profit margin of 15% and reduce operating expenses by 5%. Market conditions and business performance should guide regular reviews and adjustments of these goals.

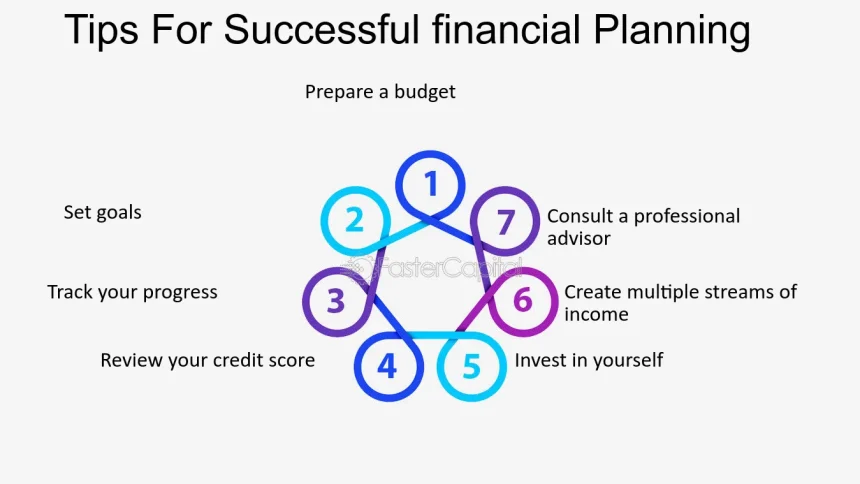

Create a Comprehensive Financial Plan

A solid financial plan demands strategic thinking and proper execution that ensures business success and personal wealth growth. Research indicates that businesses with detailed financial plans are three times more likely to achieve their growth targets.

Set Short-term and Long-term Objectives

Financial objectives come in two distinct timeframes – short-term goals span a year or less, while long-term goals stretch beyond this period. A well-structured financial plan needs clear milestones that include:

Develop Strategies for Wealth Accumulation

Smart wealth accumulation strategies focus on sustainable growth and risk management. Research shows entrepreneurs who diversify their investment strategies achieve 40% better returns over five years. Keeping business and personal assets separate protects wealth from operational risks effectively.

A practical roadmap to build wealth has these essential elements:

Plan for Business Growth and Personal Wealth

Smart entrepreneurs need to balance their business reinvestment with personal wealth creation. Studies show that entrepreneurs who master this balance are twice as likely to achieve long-term financial success. The financial plan should detail specific strategies to:

Business growth needs careful planning and smart execution. Successful entrepreneurs typically split their resources between business expansion and personal wealth building. They base these decisions on clear financial projections and market conditions. This strategy will give them sustainable growth while they protect their personal finances.

Entrepreneurs must track both business and personal financial metrics to stay on course. Financial projections should reflect predicted expenses and sales forecasts. These projections need to account for different scenarios, from best-case to worst-case outcomes.

Implement Risk Management Strategies

Risk management serves as the life-blood of entrepreneurial success. Studies reveal that [leading business risks worldwide include cyber incidents, business interruption, and natural catastrophes](https://www.allianz.com/en/press/news/studies/220113_Allianz-Risk-Barometer-2022-cyber-perils-outrank-Covid-19-and-broken-supply-chains.html).

Get the Right Insurance Coverage

Business owners need detailed insurance coverage to protect their interests. Your business needs these types of insurance:

Studies indicate that [businesses with detailed insurance coverage are better positioned to recover from unexpected setbacks](https://www.thehartford.com/business-insurance/strategy).

Vary Investments

Entrepreneurs can manage risk better through investment diversification. Research shows that [entrepreneurs who maintain diversified portfolios achieve more consistent returns and reduced volatility](https://www.jpmorgan.com/wealth-management/wealth-partners/insights/the-importance-of-being-diversified). Smart diversification strategies include:

Create an Emergency Fund

Financial experts suggest keeping three to six months of operating expenses in an emergency fund. This fund is a vital safety net that protects your business during economic downturns and unexpected challenges. Your business needs to:

Statistics show that businesses with adequate cash reserves are three times more likely to survive economic downturns.

Optimize Tax Planning and Business Structure

Tax optimization and business structure selection are the life-blood of entrepreneurial financial management that works. Businesses can save up to 20% on their qualified business income through proper tax planning and strategic deductions, according to recent studies.

Choose the Right Business Entity

Your business structure substantially affects tax obligations and liability protection. C-corporations must pay a corporate tax rate of 21%, while LLCs and S-corporations operate as pass-through entities that flow profits directly to individual tax returns. Businesses earning less than INR 83.77 billion annually can achieve considerable tax savings by selecting an appropriate structure.

Maximize Tax Deductions

Self-employed entrepreneurs can utilize several tax deductions to reduce their tax burden. These deductions help optimize their financial position:

The tax authorities require proper documentation and record-keeping. Business expenses from cash transactions above INR 10,000 per day might not qualify for deductions.

Plan for Exit Strategies

Business owners should think about their exit plans when they start their business. Here are the most common ways to exit:

Studies show that businesses with clear exit plans are three times more likely to get better financial results during transitions. A detailed exit strategy can boost your business value by showing solid long-term planning and sustainability.

Tax benefits play a crucial role in your exit plan. Working with financial advisors will help you structure your business and match your exit strategy with your future goals. This smart approach helps you stay compliant and maximize tax advantages as your business grows and transitions.

Conclusion

Entrepreneurs just need a strategic approach to become skilled at financial planning that combines a full picture, detailed planning, and careful risk management. Business success comes from entrepreneurs who keep their personal and business finances separate while implementing strong risk management strategies. A solid foundation for growth emerges through strategic tax planning and proper business structure selection that helps entrepreneurs build wealth and protect their assets.

Success in finance goes beyond profit margins and revenue targets. Business owners who adopt detailed financial planning build resilient companies that can handle economic challenges and market changes. Business owners position themselves for long-term prosperity through regular financial metric monitoring, strategic diversification, and adequate insurance coverage. These core practices create a framework that supports business expansion and personal wealth growth to ensure eco-friendly growth in the future.