Smart wealth management strategies make the difference between investors who thrive and those who struggle with asset growth. The numbers tell the story – investors who follow structured wealth management approaches get 25% higher returns than those managing money without a plan. A systematic approach works best when it combines investment management, risk assessment, and long-term planning to build and preserve wealth.

This detailed guide shows you everything you need to create and implement resilient wealth management strategies. You’ll learn to assess your financial goals and develop investment plans that optimize tax efficiency. Regular portfolio monitoring helps maintain balance. The guide also covers risk management and financial planning basics to help you make smart decisions about your financial future.

Understand Your Financial Goals and Risk Tolerance

Understanding your financial goals and risk tolerance creates the foundation that makes wealth management work. A newer study found that 20% of individuals aged 50 and above had no retirement savings. This statistic shows why proper financial planning matters so much.

Assessing your current financial situation

Your wealth management journey starts with a complete financial review. This process helps you calculate your net worth by adding up all assets and subtracting debts. You should perform this assessment each year and after major life changes like marriage, divorce, or switching careers.

You can boost your financial health by focusing on these three areas:

- Setting up a practical budget to track income and expenses

- Building an emergency fund (ideally 3-6 months of living expenses)

- Managing and reviewing your current debt obligations

Defining short-term and long-term financial objectives

Financial goals vary substantially based on individual circumstances and time horizons. Short-term goals typically span up to one year, while long-term objectives extend beyond five years. Research indicates that achievable short-term goals provide a psychological boost that strengthens your dedication to long-term financial planning.

People need to think over these aspects while setting financial objectives:

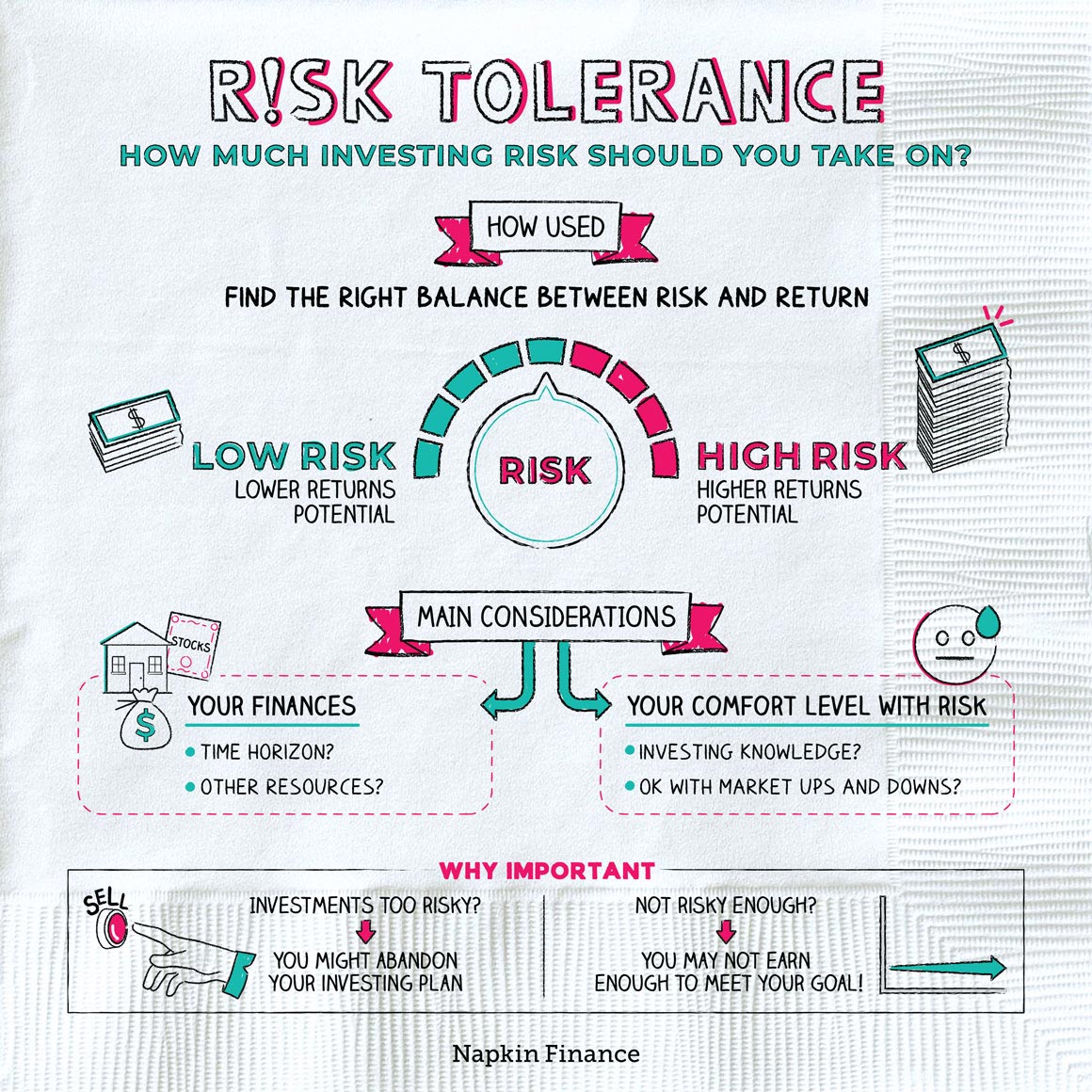

Determining your risk appetite

Your risk tolerance is very personal and changes based on many factors. People who earn steady, predictable incomes tend to take more investment risk than those with changing salaries.

Your age plays a big part in measuring risk. Younger investors usually have more time to bounce back from market drops. Financial advisors give detailed surveys to review how much risk you can handle. They look at:

Life events can change your risk appetite by a lot, so you need to check it often. Money experts suggest you should look at your risk tolerance every year. This becomes even more important when big changes happen in your life – like getting married, switching jobs, or getting close to retirement.

Your income stability shapes how much risk you can take. Studies show that you can usually handle bigger investment risks if you have multiple ways to earn money or a solid emergency fund. But remember – your risk tolerance isn’t fixed. You need to review and adjust it as your life changes.

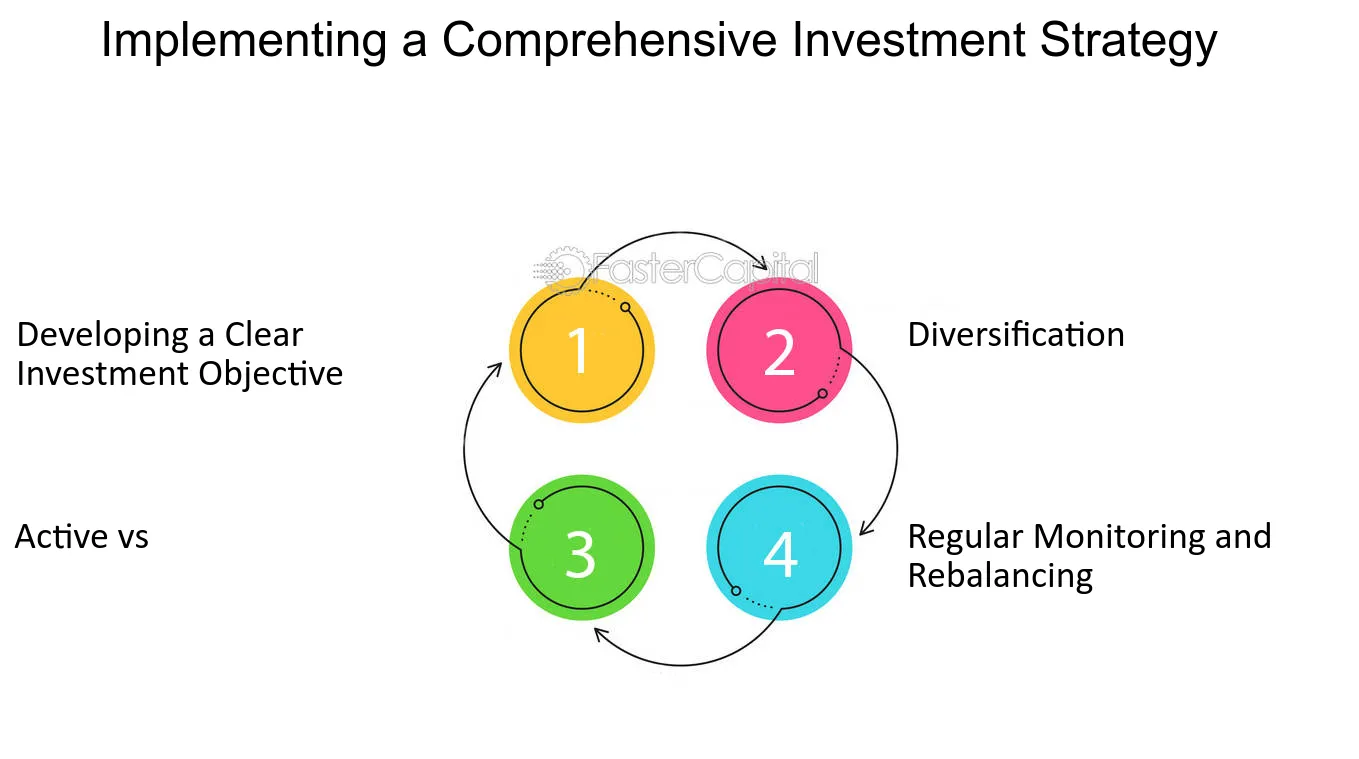

Develop a Comprehensive Investment Strategy

A reliable investment portfolio emerges from thinking over multiple factors and careful planning. Investors who follow Modern Portfolio Theory aim to maximize their returns and optimize risk through diversification.

Asset allocation and diversification

Successful wealth management strategies depend on asset allocation as their life-blood. A balanced portfolio typically contains 60% stocks and 40% bonds, though individual circumstances can alter this ratio. Long-term stability comes from strategic asset allocation, and investors can leverage tactical allocation to seize short-term market opportunities.

Market volatility meets its match in diversification. Portfolios with uncorrelated assets deliver more stable returns because different asset classes tend to move independently. To name just one example, bonds often move opposite to declining stocks, which helps maintain the portfolio’s overall stability and performance.

Choosing appropriate investment vehicles

Investment vehicles are the foundations of a well-laid-out portfolio. Here are the main investment options that financial experts want you to think about:

Your choice of investment vehicles affects portfolio performance by a lot. Data shows that index funds and ETFs typically charge an average fee of 0.18% while actively managed mutual funds cost 4.17%. This makes index funds and ETFs a more budget-friendly choice for many investors.

Balancing growth and income investments

A strategic approach helps create the right balance between growth and income investments. Here’s what financial advisors suggest you should do:

Research shows that investors in their early 50s should maintain 60-70% in growth investments. This percentage should gradually decrease to 20-30% as retirement approaches. Such a transition protects your wealth while it continues to grow.

These strategies work best with regular monitoring and adjustments. Studies reveal that disciplined portfolio rebalancing leads to better performance compared to static portfolios. Investment professionals suggest you should review your allocation yearly to match your financial goals and market conditions.

Implement Tax-Efficient Strategies

Tax optimization is a vital part of detailed wealth management that helps investors save most important amounts in yearly tax obligations. Studies indicate that personalized tax planning enables investors to retain up to 20% more of their investment returns through smart tax reduction strategies.

Utilizing tax-advantaged accounts

Tax-advantaged accounts help you build wealth effectively. You can contribute up to INR 586,359.93 to IRAs during 2024, and if you’re 50 or older, this limit increases to INR 670,125.63. The 401(k) plans allow contributions up to INR 1,926,611.20, while the total employee and employer contributions can reach INR 5,779,833.59.

Key tax-advantaged account options include:

Tax-loss harvesting techniques

Tax-loss harvesting helps you reduce tax liability through smart investment moves. This strategy lets you sell investments at a loss to offset capital gains, and you can claim up to annual limit of INR 251,297.11 as income tax deductions. Important considerations include:

Your portfolio benefits the most when you put the tax savings back into investments. Studies show that you can control 37% of tax-loss harvesting success through harvest timing and portfolio structure.

The best results come when you stay clear of “wash sales.” This means you should not buy similar securities 30 days before or after taking a capital loss. Following this rule protects your tax benefits and keeps your portfolio strategy on track.

Estate planning for tax optimization

Estate planning helps preserve family wealth for future generations. You can give up to INR 3,000 yearly to each person without paying taxes under the current gift tax exemption. Strategic estate planning includes:

Donor-advised funds are a great way to get tax advantages if you have substantial wealth. These funds let you claim immediate tax deductions while choosing when to distribute your charitable gifts. It also helps to set up charitable remainder trusts (CRATs and CRUTs) that benefit both charitable causes and provide tax advantages.

Tax laws change often, so you need to review and adjust your tax strategies regularly. Expert financial advisors suggest checking your portfolio every quarter. This helps you find ways to save on taxes and keeps your strategy in line with current rules. A proactive strategy lets you adapt to new tax laws while building wealth efficiently.

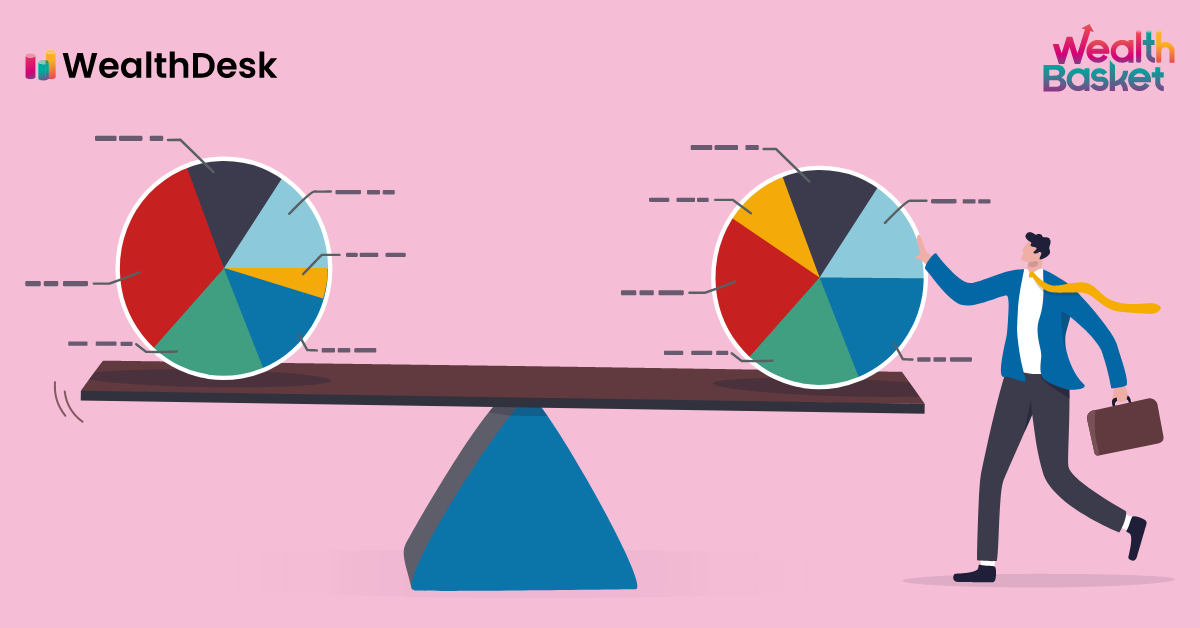

Monitor and Rebalance Your Portfolio Regularly

Portfolio monitoring and rebalancing stand as significant components that make wealth management strategies work. Research shows that investors who monitor and rebalance their portfolios consistently can generate an additional 0.04% in returns annually. This practice leads to long-term financial success.

Setting up a review schedule

How often you review your portfolio substantially affects your investment outcomes. Some investors prefer yearly reviews, while others choose to evaluate more frequently. Professional wealth management firms, including Covenant Wealth Advisors, conduct portfolio reviews every couple of weeks to properly arrange their client’s investments.

A regular review schedule offers these valuable benefits:

Adjusting asset allocation as needed

Portfolio rebalancing uses a systematic process to keep desired asset allocations intact. Asset classes that deviate by 5% or more from their target weights need rebalancing measures according to experts. Everything in this process includes:

Rebalancing Strategies Investors have several rebalancing approaches to choose from. Calendar rebalancing stands out as the quickest way that adjusts portfolios at set times. The percentage-based rebalancing offers another option that triggers changes once allocations move beyond specific ranges.

Matching Performance Against Standards

Portfolio performance needs careful comparison with appropriate standards. Investment companies match their portfolio performance with standards that line up with their investment universe. A balanced portfolio might use this mix as a standard:

Performance Analysis Components Good performance analysis includes several key areas. Performance attribution shows how returns were achieved. Performance appraisal uses both returns and attribution to assess the investment process quality. This all-encompassing approach helps investors:

Portfolio monitoring must adapt to changing circumstances. Life’s big moments often need strategy adjustments – career shifts, family additions, or retirement planning. Economic conditions might also need quick changes to grow and protect wealth.

Investment experts stress the value of long-term thinking with regular checkups. Vanguard suggests portfolio reviews twice yearly and rebalancing when values move 5% or more from targets. This balanced strategy cuts down on excess trading while keeping portfolios in line with investment goals.

Regular checks protect against unexpected risks. Portfolio rebalancing adds protection and discipline to any investment plan, whether personal or professional. Consistent monitoring and smart rebalancing help investors keep their desired risk levels while maximizing potential returns.

Conclusion

Smart wealth management needs a well-laid-out approach that combines clear financial goals, strategic investment planning, tax optimization, and portfolio maintenance. Research shows that investors who use structured wealth management strategies get substantially better results. Their potential returns are up to 25% higher than those who manage wealth without a complete plan. These elements work together naturally – your goals guide investment choices, tax efficiency keeps your wealth growing, and regular monitoring keeps everything on track.

Your success in personal wealth management comes from applying these principles consistently while staying flexible enough to adapt when things change. The data proves that disciplined portfolio rebalancing and tax-efficient strategies can preserve up to 20% more of your investment returns. You can generate extra gains through systematic monitoring. Investors who follow these proven methods set themselves up for long-term financial success and build lasting wealth through different market cycles and economic conditions.