Millennials today deal with money challenges unlike any generation before them. Living costs keep rising, and the economic landscape of 2024 has changed how they handle their finances. Their financial planning needs a fresh view that considers student loans, job-hopping trends, and investment options in our digital world.

Success with money comes from mixing smart investments with retirement plans and creating different income sources. Technology has made financial education more available than ever before. Smart tax planning helps people save more money effectively. This piece shows real steps millennials can take to build a strong financial future. They’ll learn about digital tools that work and how to get ready for life’s big moments.

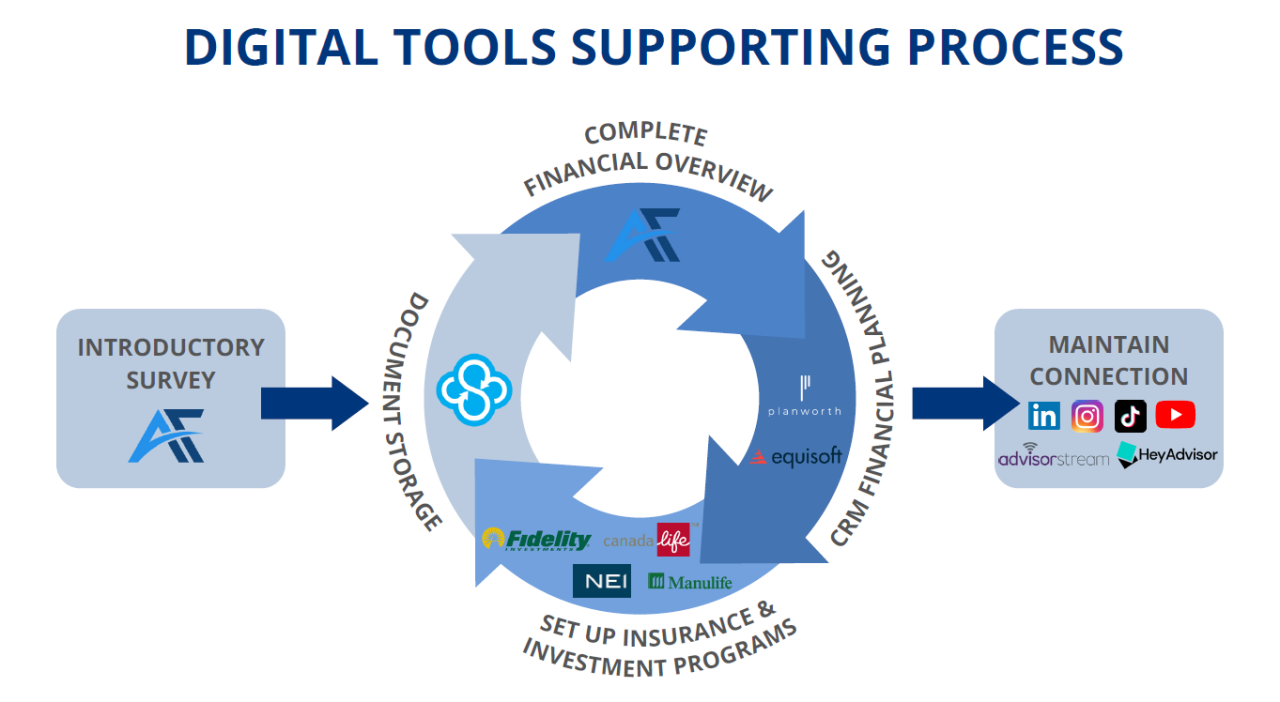

Embrace Digital Tools for Financial Management

Technology plays a key role in managing money today. Modern financial tools make it simple for millennials to handle their finances with convenience and smart features. These tools help them build a better financial future.

Use personal finance apps and robo-advisors

Robo-advisors have made investing more democratic and are especially available to beginners and investors with lower net worth. These automated investment platforms charge low fees and management costs between 0.25% and 0.50% annually. You can start investing with minimal amounts, as some platforms accept deposits from ₹83.77 to ₹8,376.57.

Modern personal finance apps give you these benefits:

Explore online budgeting and investment platforms

Online budgeting platforms now give users complete financial management solutions. These platforms use different budgeting methods like zero-based budgeting that will give a specific purpose to every dollar. The platforms can connect to multiple financial accounts and track spending patterns while sending alerts about upcoming bills.

Wealth front stands out among investment platforms with innovative features such as:

Use AI-powered financial planning tools

AI has reshaped financial planning with smart tools that boost decision-making and automation. These AI-powered solutions deliver better accuracy in budgeting and forecasting and automate routine tasks. Users can spot trends and fix potential problems early with immediate financial insights.

Modern AI financial tools excel in:

These digital tools have made banking better with quick transactions and smart money management features. The platforms keep your information safe with two-factor authentication and encrypted transactions while staying convenient. AI-powered advisors use smart algorithms to give you personal investment advice that matches your financial goals.

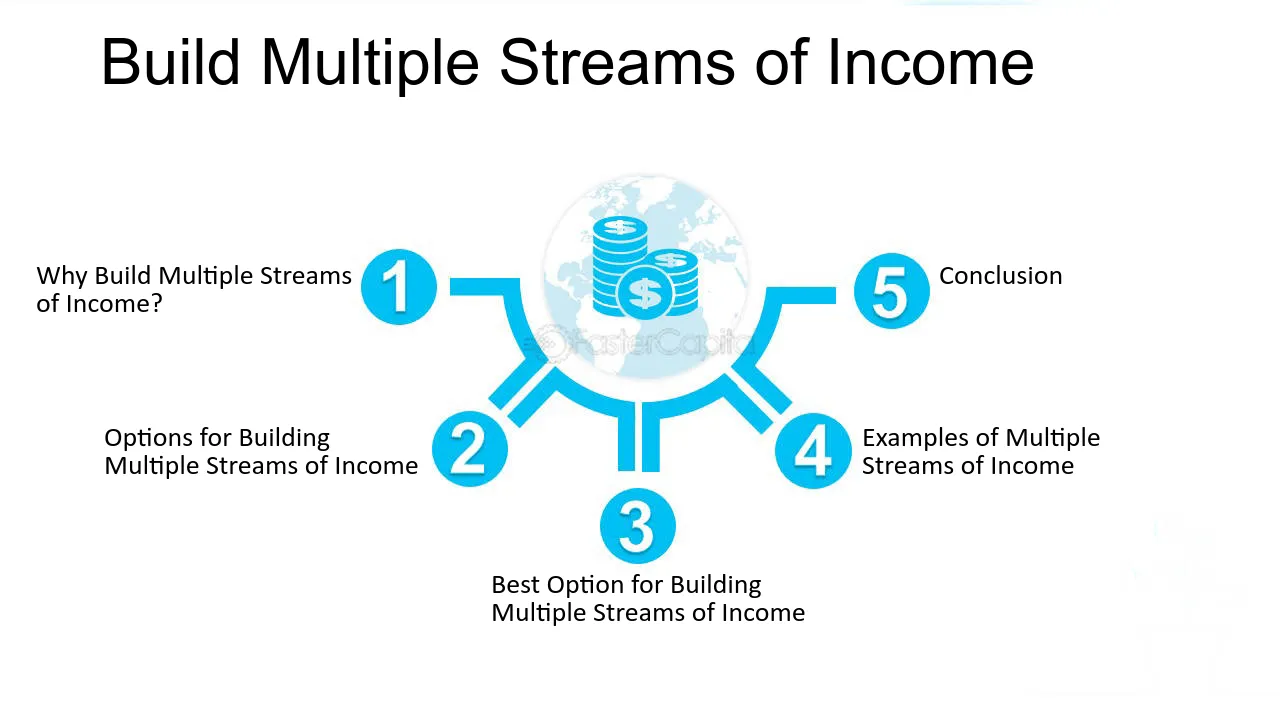

Develop Multiple Income Streams

The ever-changing economic world makes broadening income streams a significant strategy to achieve long-term financial stability. Research shows that multiple revenue channels provide financial security and accelerate wealth accumulation and personal growth.

Explore side hustles and freelance opportunities

The freelance world has grown substantially with over 54 million freelancers in America. Millennials can boost their earnings through freelancing that pays around ₹1,759.08 per hour. This extra income stream could add ₹83,765.70 to your monthly budget.

Professional freelancing opportunities include:

Invest in passive income sources

Passive income streams need original effort but can generate steady revenue with minimal work over time. The marketplace has plenty of opportunities to build passive income streams, especially when you have interests in real estate and digital products.

These passive income opportunities stand out:

Think over starting an online business

The digital world offers amazing opportunities right now. India’s e-commerce market will reach USINR 9297.99 billion by 2024 and USINR 16753.14 billion by 2026. You’ll find several advantages when you start an online business:

Lower Entry Barriers: You need minimal startup capital compared to traditional businesses. The infrastructure costs stay low, and you retain control over operations and management.

Market Reach: Your business can reach customers worldwide. You’ll know how to target specific demographics while increased digital literacy drives market growth.

Online shoppers will grow to 427 million by 2027. This creates so big opportunities for entrepreneurs. Your online business needs proper planning, market research, and a clear business model. You must understand legal requirements too. Success comes from finding a profitable niche, building a solid business plan, and delivering great customer service.

Amazon, Nykaa, Myntra, and Flipkart show what’s possible in online marketplaces. The industry will grow beyond INR 29318.00 billion by 2030. This growth opens substantial opportunities for millennials who want to enter the digital business space.

Optimize Tax Planning and Savings

Tax planning is the life-blood of sound financial management and gives millennials the most important ways to build wealth. Smart tax strategies affect your financial success in the long run.

Understand tax-advantaged accounts like 401(k)s and IRAs

Tax-advantaged retirement accounts help you reduce current tax liability and build future wealth. Your traditional 401(k) contributions come from pre-tax dollars and reduce your taxable income for that year. The maximum contribution limit reaches INR 1,926,611.20 for 401(k) plans in 2024, and people aged 50 and older can add INR 628,242.78 as a catch-up contribution.

Roth IRAs provide different but equally valuable advantages. You make contributions with after-tax dollars, but qualified withdrawals during retirement remain completely tax-free. You can contribute up to INR 586,359.93 to Roth IRAs in 2024, and if you’re 50 or older, you can add INR 83,765.70 more.

Maximize deductions and credits

Smart tax planning helps millennials take advantage of available tax benefits. The core tax credits and deductions that can save you money include:

Married couples who file jointly can make Roth IRA contributions when their modified adjusted gross income (MAGI) stays below INR 19,266,111.97 in 2024. Single tax filers have the chance to contribute fully if their MAGI remains under INR 12,229,792.82.

Smart tax-efficient investment strategies

Smart portfolio management helps you invest efficiently while saving taxes. Taxes can substantially affect your investment returns, especially with Securities Transaction Tax (STT) and short-term capital gains tax of 15%.

Strategic Tax-Saving Approaches:

Your investment timing and account choices determine tax efficiency. Tax-deferred accounts like traditional IRAs and 401(k)s reduce your current tax burden. Roth accounts help your money grow tax-free. Taxable investment accounts offer more flexibility after you max out retirement accounts.

Long-term Tax Planning Considerations:

Many people believe taxes automatically decrease during retirement. Your income levels might stay stable or rise, so smart tax planning helps secure your financial future.

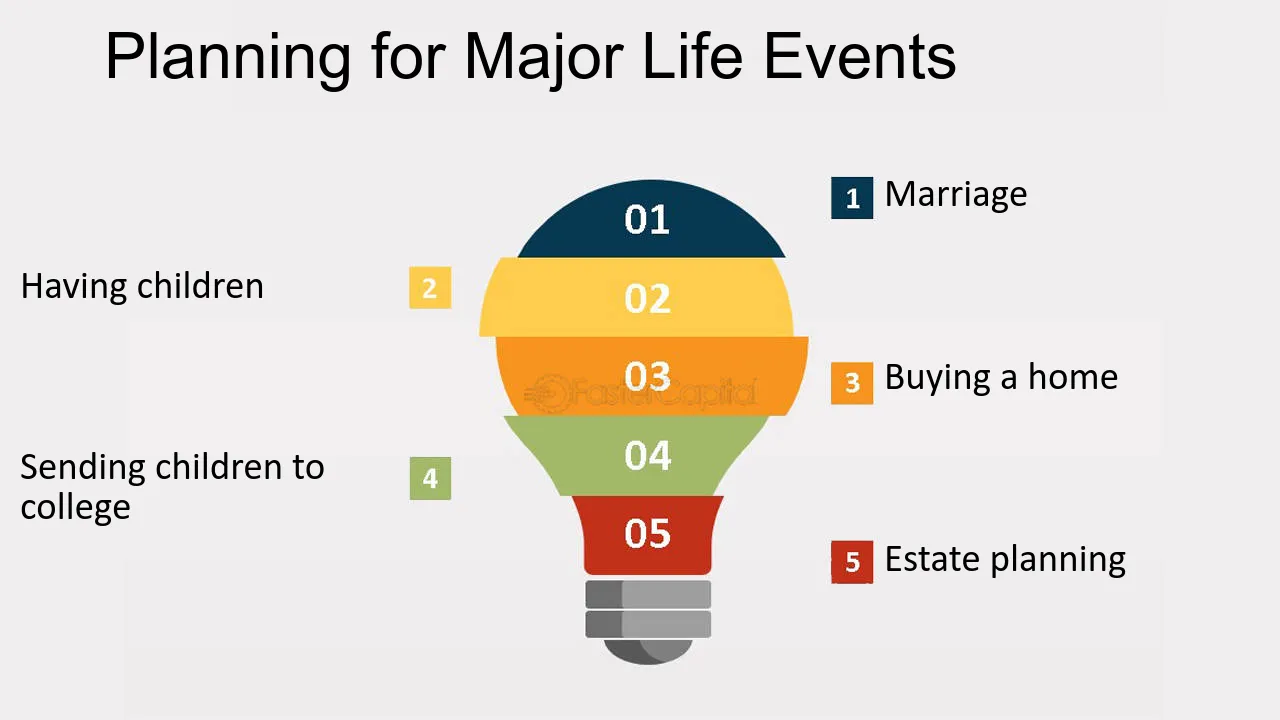

Plan for Major Life Milestones

Millennials face significant turning points through their financial experience that demand careful planning and strategic resource allocation. Financial stability depends on proper preparation for these most important life events rather than dealing with financial stress.

Save for a down payment on a home

Homeownership needs serious money in the bank, and median new home prices exceeding INR 33,506,281.69 make this clear. Most people buying their first home put down 6% to 7% of the purchase price. Financial experts suggest saving at least 20% of your home’s price to avoid paying private mortgage insurance (PMI).

Smart ways to build your down payment:

Prepare financially for marriage and family planning

Marriage comes with major financial responsibilities that need careful thought. Money problems rank among the top reasons couples get divorced, and with good reason too. The cost of raising a child has been updated to INR 83.77 million, which is a big deal as it means that couples need to start their financial preparation early.

Essential Marriage Financial Planning Steps:

Family financial planning (FFP) is a vital systematic approach to managing resources. It goes beyond just handling monthly income and spending. The plan includes everything from retirement to real-life investments in real estate. This comprehensive approach helps build lasting financial security for the whole family.

Think about insurance needs (health, life, disability)

Insurance is a vital part of complete financial planning. Young professionals need the right coverage types and amounts to protect themselves from unexpected events and money problems.

Key Insurance Points to Remember:

- Health Insurance

- Life Insurance

- Disability Insurance

Financial experts suggest keeping an emergency fund that covers three to six months of expenses with your insurance. This setup protects you from life’s expected and unexpected turns.

Your health insurance should have complete family coverage that includes:

Life changes affect your insurance needs. Look out for:

You should review and update your insurance coverage yearly. Regular checks help you find affordable coverage that fits your family’s changing needs and financial goals.

Conclusion

Millennials in 2024 just need a balanced mix of tech advantages and time-tested money-making principles to achieve financial success. Modern digital tools give easy access to advanced money management features. Multiple income streams are a great way to get protection against economic uncertainty. Smart tax planning and careful investments build strong foundations that help accumulate wealth over time. These tools make financial goals easier to reach than ever before.

Smart planning for life’s big moments and tax-efficient strategies help millennials propel development throughout their careers. Starting complete financial planning early gives you the most important benefits, especially when you have plans for buying a home, getting married, or starting a family. These coordinated efforts, backed by proper insurance and emergency funds, create a strong money framework that adapts to life changes and builds lasting wealth.