Professional investment relationships between asset managers and their clients need a solid investment management agreement as their foundation. This significant document defines how investment professionals will manage their clients’ assets through specific terms, conditions, and expectations. A well-laid-out investment management agreement protects both parties and sets clear guidelines throughout their investment relationship.

Creating an effective management agreement demands attention to several core components like investment objectives, fee structures, and reporting requirements. A detailed investment management agreement template should tackle liability concerns, outline specific investment strategies, and set clear performance standards. This piece explores everything in creating a resilient agreement that protects all parties’ interests while ensuring transparent and effective asset management.

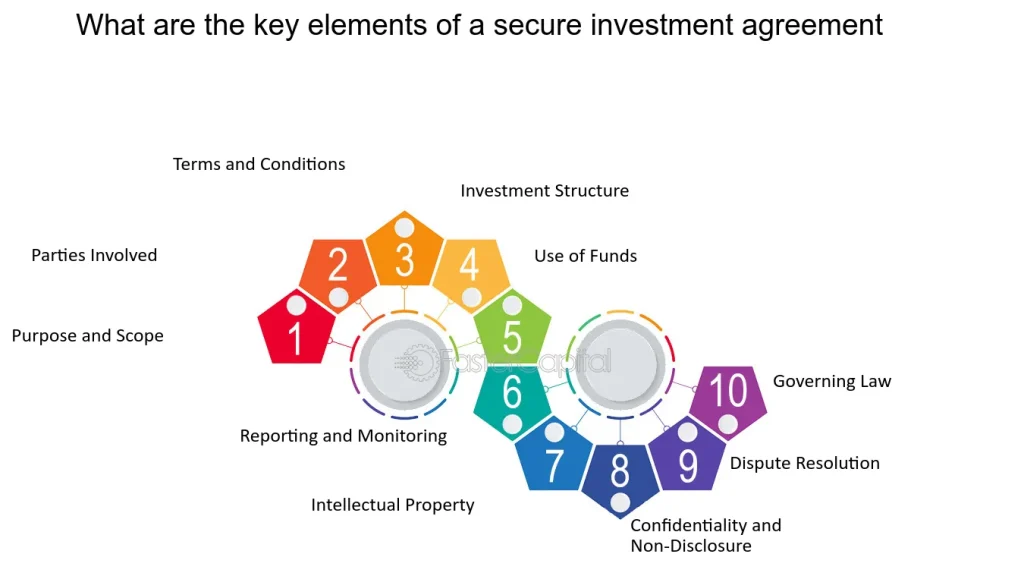

Key Components of an Investment Management Agreement

Investment management agreements (IMAs) include several key components that are the foundations of a successful investment relationship. These components create a complete framework that helps manage investment portfolios better.

Scope of services

This section outlines what investment managers can do and their level of control. Investment managers typically offer these key services:

The agreement lets managers full authority to make investment decisions within specified parameters. Managers can buy, sell, exchange, or handle assets as they consider appropriate.

Investment objectives and strategies

This section outlines both main and secondary investment objectives that shape portfolio management decisions. The main goals focus on:

Investment strategy details show how managers achieve these objectives through asset allocation, diversification, and risk management techniques. The strategy arranges with the investor’s time horizon, income requirements, and risk tolerance levels.

Fees and expenses

Investment management agreements’ fee structure has several key components:

Actively managed funds command higher fees than their passive counterparts, though research shows these higher costs do not necessarily relate to improved performance.

Reporting requirements

Complete reporting practices are the foundations of client relations and portfolio management. Investment reports must include:

Quality reports significantly impact client retention. Companies must deliver critical information promptly and share valuable insights based on their analysis. Reports should meet regulatory obligations and contain adequate information that helps recipients understand the content and reasoning behind the presented data.

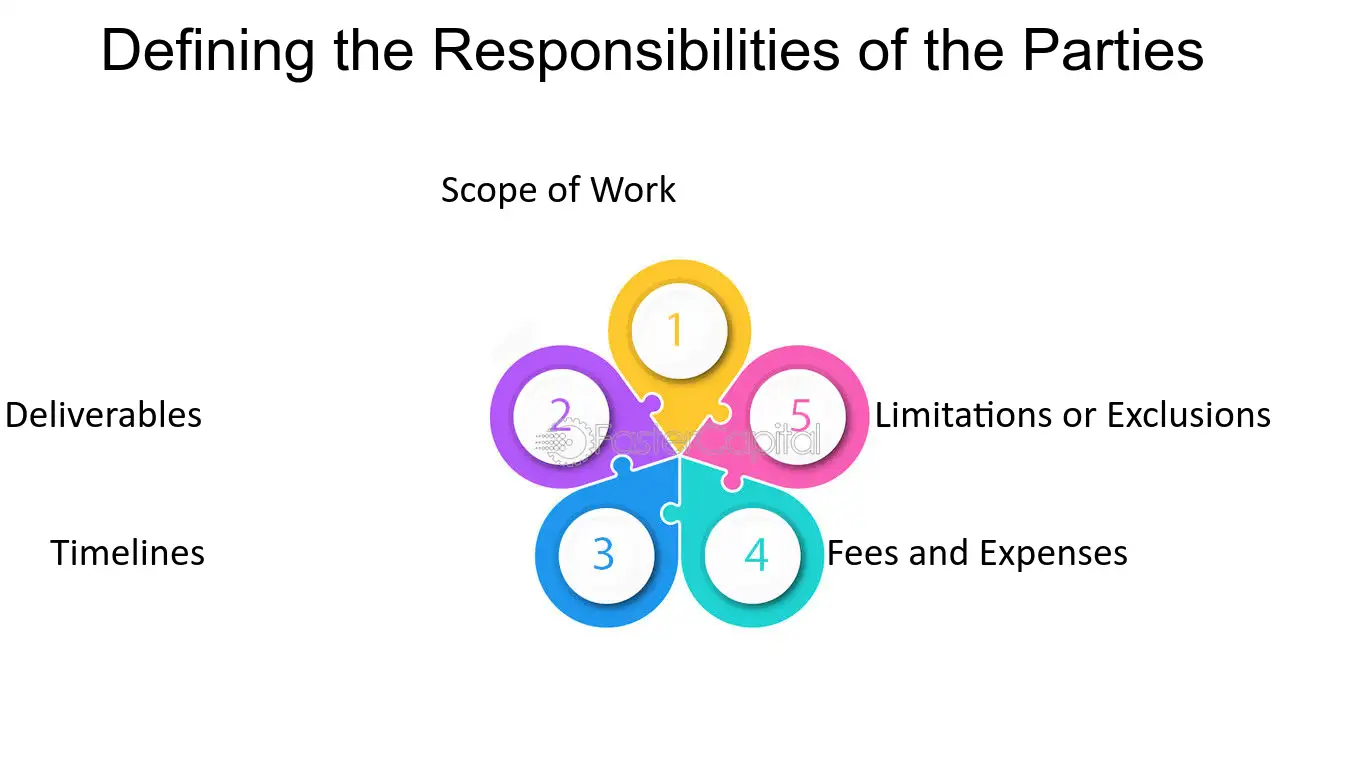

Defining the Parties and Their Responsibilities

A clear understanding of roles and responsibilities is the life-blood of any successful investment management relationship. The investment management agreement helps each party understand and fulfill their specific obligations that ensure proper portfolio management.

Manager’s duties and obligations

Investment managers act as fiduciaries who oversee client portfolios and make informed investment decisions. Their key responsibilities include:

Investment managers handle essential portfolio activities that range from securities trading to settlement processes and performance tracking. They watch market movements to make smart investment choices for their clients. Their earnings come from a percentage of assets under management.

Client’s responsibilities

A client does more than just invest money. They need to take an active role in the relationship through clear communication and sharing key information. Clients need to share accurate details about their financial goals, risk tolerance, and investment priorities. The manager needs current and complete information to properly assess if investments are suitable.

Regular Communication: Clients should keep open communication lines with their investment managers, especially when they face major financial decisions that could affect their investment strategy. They need to review and respond to important documents quickly and keep talking about any changes in their financial situation or goals.

Custodian’s role

A custodian acts as an independent third party that protects client assets and provides critical oversight. The custodian’s main goal focuses on loss prevention through asset protection. Custodians “sit between” investment managers and assets to add security and control.

Core Functions: A custodian’s essential services include:

Custodians hold control of assets under their name, the client’s name, or through a nominee structure. Their duties cover collection, physical acquisition, and asset safekeeping. Investment managers cannot act as custodians or register assets under their names.

Investment Guidelines and Restrictions

Investment guidelines and restrictions are the foundations of regulatory control over client asset management. These rules help managers line up their strategies with client goals and meet all regulatory requirements.

Asset allocation

Asset allocation is the life-blood of portfolio management strategy. Research shows that asset allocation is [the most important determinant of an investor’s long-term investment results]. The main goal aims to [reduce investment risk through diversification across multiple asset classes].

Portfolio managers should think over these key allocations:

Investment managers need to understand that [some assets providing market-linked returns may be affected by market volatility]. This makes it significant to balance risk and return potential in various asset classes.

Permitted investments

Investment management agreements need to specify clearly what types of investments and strategies are allowed. Managers usually get [full discretionary authority to execute various investment activities] that include:

- Buying, selling, and exchanging assets

- Participating in new issues and offerings

- Managing underwriting activities

- Executing foreign exchange transactions

- Engaging in derivative transactions

These activities must line up with the current investment guidelines and [cannot be breached due to market movements or circumstances outside the manager’s reasonable control].

Prohibited transactions

Prohibited transactions shield clients from conflicts of interest and inappropriate investment activities. These rules aim to prevent misuse of client assets while you retain control of fiduciary duty.

A prohibited transaction takes place when [improper use of assets by the investment manager or related parties] occurs. These activities are not allowed:

Breaking these rules leads to heavy penalties. The IRS can charge [an initial tax of 15 percent of the fair market value of the transaction]. If violations remain uncorrected within the specified time, [additional penalties of up to 100 percent] may apply.

Investment managers need resilient compliance systems to prevent these transactions and follow investment guidelines. They must monitor and report regularly to spot potential violations early. This protects both the client’s interests and the manager’s fiduciary duties.

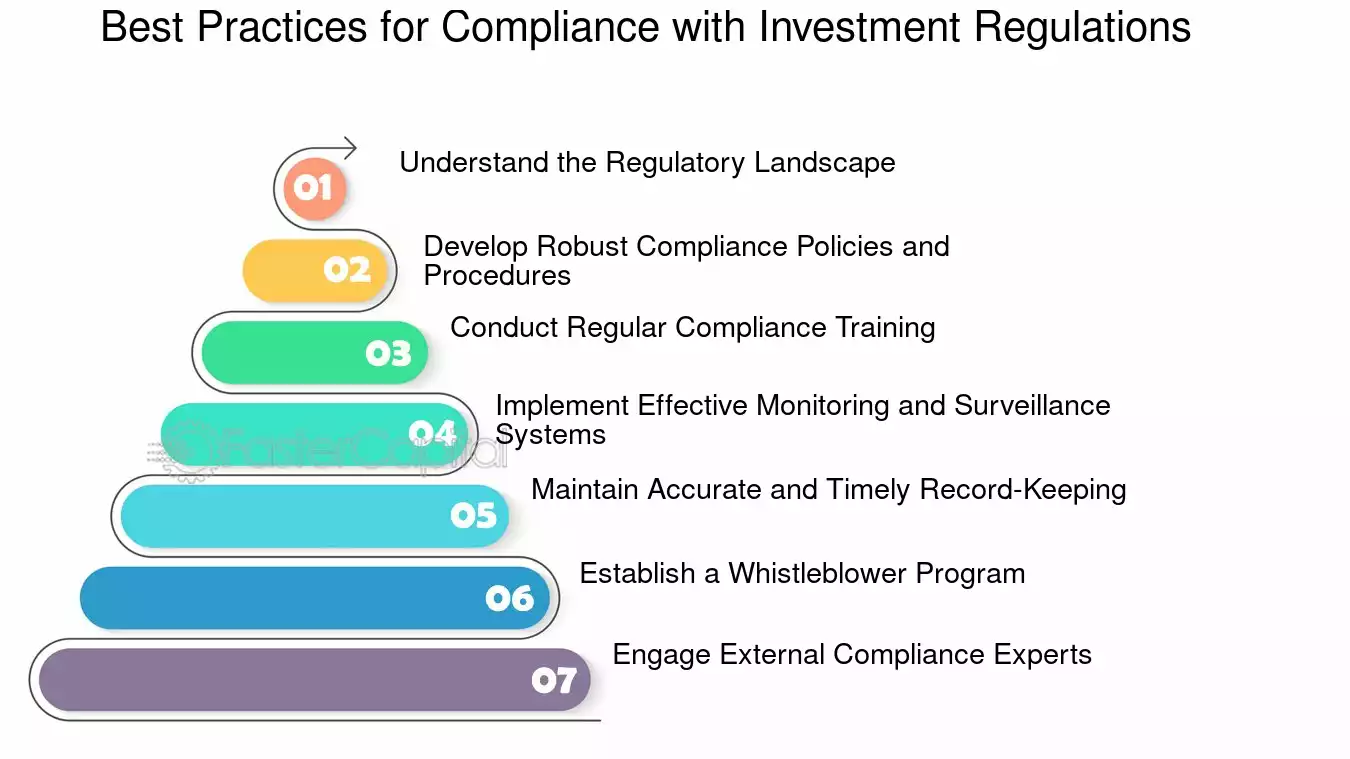

Risk Management and Compliance

Risk management and compliance are the life-blood of successful investment management operations. Organizations now focus on detailed risk oversight because market volatility and regulatory scrutiny continue to grow.

Risk monitoring and reporting

Investment management firms need strong risk monitoring systems that operate through independent Risk Management Units (RMUs). These specialized units handle several key functions:

Organizations invest $5.47 million on compliance compared to $14.82 million for non-compliance. These numbers demonstrate why proactive risk management matters significantly.

A strong risk framework starts with a detailed Risk Management Process (RMP) document that outlines and explains the risk management structure. The framework relies on three lines of defense:

- Portfolio managers as primary risk handlers

- Independent risk review function

- Group Risk oversight at the board level

Compliance with laws and regulations

Investment management firms must follow strict regulations. A robust compliance system stands at the core of their operations. Their compliance framework covers several essential areas:

Regulatory Requirements

Portfolio managers need to align their portfolios with both regulatory requirements and investment agreement policies. Compliance departments have transformed their role significantly. They no longer just offer advice but actively manage and monitor risks.

Conflicts of interest

Investment managers must pay special attention to conflicts of interest that can emerge between different parties:

Every organization needs a conflict register and clear procedures to handle these situations. Teams must take specific steps if conflicts cannot be avoided:

- The compliance department needs immediate notification

- Appropriate disclosure should resolve conflicts

- All parties’ interests deserve fair consideration

- Every step of conflict management requires proper documentation

Recent studies reveal that managers, investors, and clients understand risk management better now. This knowledge has created a stronger need to monitor asset management activities. Many organizations have responded by creating standalone risk management teams. These teams track risk exposure and make sure it matches predetermined risk budgets.

Performance Evaluation and Benchmarking

Performance evaluation and measurement are significant components that determine investment management strategies’ effectiveness. Research demonstrates that performance evaluation helps understand investment process quality and suggests ways to boost portfolio management.

Setting performance objectives

A client’s financial goals and risk tolerance should line up with their investment performance objectives. Portfolio performance measurement shows the overall results, and performance attribution reveals the methods that achieved these results. The evaluation process includes three key elements:

Performance Measurement: Provides quantitative assessment of portfolio returns Attribution Analysis: Explains the sources of performance Risk-Adjusted Evaluation: Shows performance relative to risk taken

Studies show that portfolio performance evaluation helps investors detect profitable assets quickly and identify underperforming investments that drain resources without adequate returns.

Choosing the Right Performance Measures

The right performance measures are the foundations of meaningful performance evaluation. A good performance measure should have these key characteristics:

Research shows that benchmark misspecification leads to wrong performance calculations and makes attribution analysis invalid. Portfolio managers think over both market indices and custom measures to evaluate performance. Here are some common market indices used:

| Benchmark Type | Application |

|---|---|

| S&P 500 | Large-cap U.S. stocks |

| Russell 2000 | Small-cap stocks |

| MSCI EAFE | International markets |

| Lehman Bond Aggregate | Fixed income |

Review and evaluation process

Portfolio performance needs regular monitoring and assessment against proven standards. Several investment performance ratios measure investment skill, such as the Sortino ratio, upside/downside capture ratios, and maximum drawdown.

The evaluation process focuses on these vital components:

- Regular Performance Assessment: Market conditions change constantly. A yearly investment review ensures everything stays aligned with your investment goals.

- Detailed Analysis: The team should use performance results to evaluate the investment approach’s quality and share outcomes with stakeholders.

- Risk-Adjusted Evaluation: Teams must understand how they achieve performance results and interpret data carefully within each evaluation method’s limits.

A quality evaluation looks at both returns and attribution patterns. Research demonstrates that portfolios with variety generate higher returns and face lower total risk and losses compared to homogeneous ones.

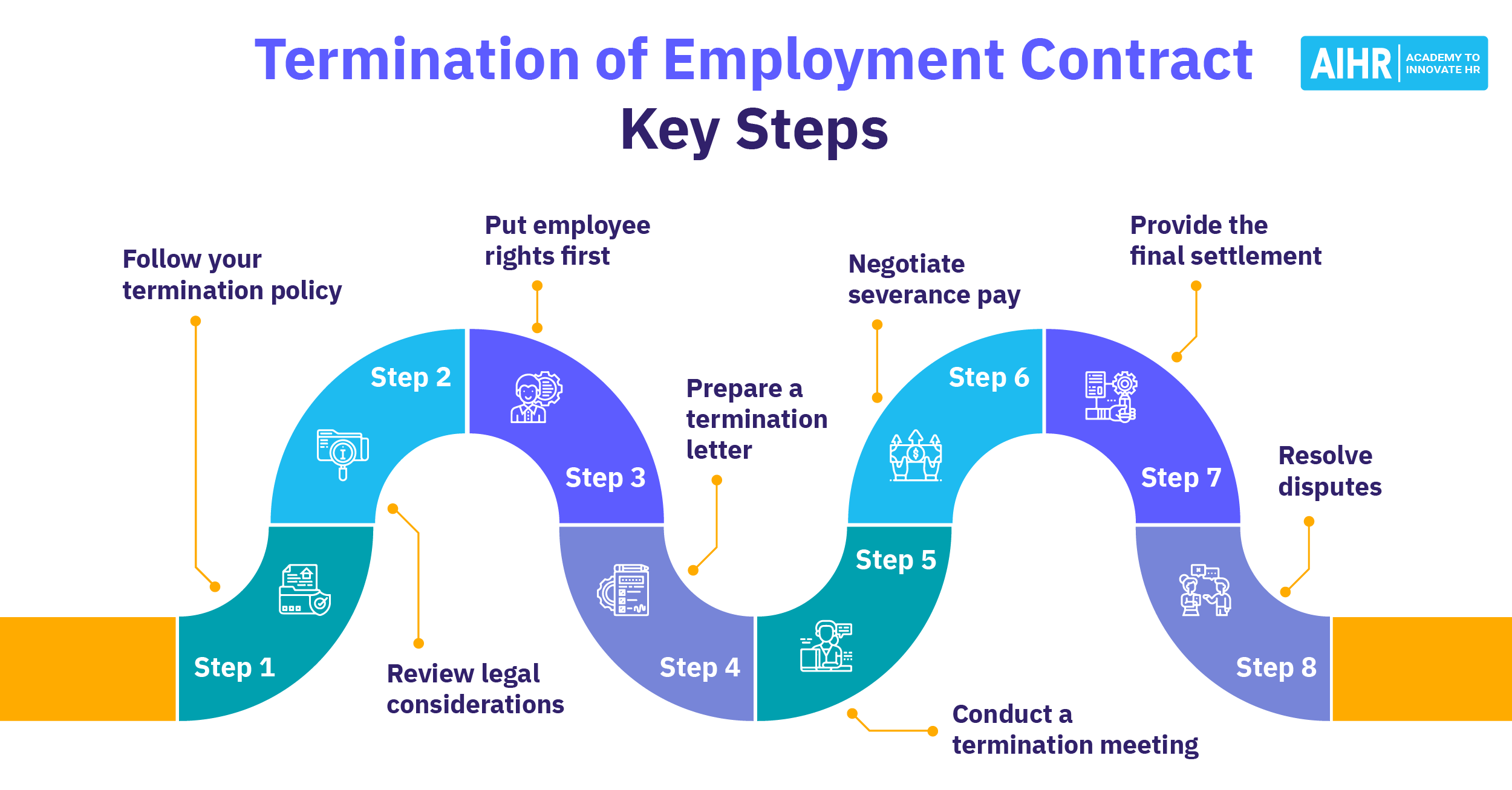

Termination and Transition Provisions

Investment management agreements need proper termination and transition provisions that protect everyone’s interests and enable smooth asset transfers. These essential provisions act as safeguards when investment managers and clients end their business relationship.

Termination events

Investment management agreements outline specific conditions that can end the agreement. Research reveals that [termination clauses in investment agreements] follow two primary approaches: ‘tacit renewal’ and ‘fixed-term’. The agreement can end due to several reasons:

The agreements typically include [survival clauses that last 10 to 20 years]. These clauses protect certain rights and obligations after termination and help ensure smooth transitions while safeguarding investor interests.

Notice periods

Notice periods are significant buffers that help both parties prepare for the termination process. [The standard notification period typically ranges from 6 to 12 months prior to the agreement’s expiry]. This timeframe helps parties manage:

- Proper communication with all stakeholders

- Orderly transfer of assets

- Documentation completion

- Risk management implementation

The table below shows typical notice period requirements:

| Termination Type | Notice Period | Special Considerations |

|---|---|---|

| Standard Termination | 6-12 months | Regular processing time |

| Breach of Contract | 10-30 days | Accelerated timeline |

| Mutual Agreement | Negotiable | Flexible arrangement |

| Emergency Situations | Immediate | Risk mitigation focus |

Transition of assets

Asset transition needs careful planning to keep portfolio integrity intact and lower risks. [Transition management (TM) helps move investment portfolios between different managers or markets while managing market risk and reducing transaction costs].

Key Transition Considerations: Research shows that successful transitions need these preparatory steps:

- [Establish relationships with transition managers through ongoing legal agreements]

- [Maintain transition accounts ready for trading, including global markets]

- [Ensure all necessary legal documents are in place]

- [Maintain fiduciary oversight throughout the transition]

Risk Management During Transition: Transition management providers must tackle several conflicts of interest:

Organizations should [identify and list broad issues they might encounter and search for unusual areas of risk] to create smooth transitions. This involves:

- Settlement cycles and timing

- Tax implications

- Currency considerations

- Market access requirements

Practical Implementation: Asset transitions need careful coordination among multiple parties. [No single party can be fully responsible for the entire transition event]. The team must:

Teams must also [consider interim strategies if target managers haven’t been hired]. These options include:

A good transition process should have [careful liquidity planning and well-designed transition management strategies to eliminate the need for blackout periods]. This method helps maintain market exposure while keeping transaction costs and market effects low.

Conclusion

Investment management agreements are the foundations of protecting both asset managers and their clients through well-laid-out provisions and guidelines. These agreements just need careful attention to several components. Clear service definitions, fee structures, detailed investment guidelines, and risk management protocols make up the core elements. A precise definition of roles, strong compliance measures, and evaluation systems that line up with client objectives while following regulations help these agreements work.

Professional investment relationships grow stronger with agreements that prepare for challenges throughout the investment lifecycle. Asset managers must balance their responsibilities to clients with day-to-day operations. They need to ensure smooth transitions when relationships end and keep proper documentation throughout the process. These agreements ended up creating accountability and transparency. They build the groundwork for successful long-term strategic collaborations that benefit everyone involved.

FAQs

1. How can one create an effective investment agreement?

To draft an effective investment agreement, follow these steps:

- Identify all parties involved and define their roles.

- Clearly state the investment terms and objectives.

- Outline the structure and nature of the investment.

- Perform thorough due diligence and research.

- Use language that is clear and easy to understand.

2. What elements are typically included in an investment management agreement?

An investment management agreement usually contains key provisions such as management fees, the scope of activities, and clauses for the indemnification of the manager. It also includes integrated notes that provide essential explanations and tips for drafting and negotiating.

3. What does an investment management agreement entail?

An investment management agreement is a contract between an investment manager and the trustees of a scheme, detailing the terms under which the manager will handle a portfolio of investments for the trustees.

4. What are the key steps in the investment management process?

The investment management process involves five main steps:

- Setting investment goals and objectives.

- Assessing risk tolerance to understand the potential risks and rewards.

- Determining the asset allocation.

- Building the investment portfolio.

- Regularly monitoring, reporting, and updating the portfolio as necessary.