Angel investors play a crucial role in the world of entrepreneurship and startup funding. These individuals provide capital to early-stage companies, often when traditional funding sources are unavailable. Angel investors not only offer financial support but also bring valuable experience and industry connections to help startups grow.

This article explores the significance of angel investors in the startup ecosystem. It examines how they evaluate potential investments, the benefits they bring to new ventures, and the challenges they face. The piece also discusses the relationship between angel investors and venture capitalists, highlighting their unique contributions to startup funding and development.

What is an Angel Investor?

Definition

An angel investor is a high-net-worth individual who uses their personal funds to invest in early-stage startups or companies in the initial phases of development. These investors provide seed money to promising ventures in exchange for ownership equity in the business. Angel investors play a crucial role in the entrepreneurship ecosystem by offering financial support to startups when traditional funding sources may be unavailable or insufficient.

Angel investors typically focus on early-stage businesses and startup companies that need assistance in getting off the ground. These startups usually lack the track record to interest venture capitalists and require capital to advance their product development, marketing, and sales efforts. Angel investments vary significantly, but investors often collaborate to invest between INR 8,376,570 and INR 83.77 million in total, with individual investments ranging from INR 837,660 to INR 8,376,570.

Characteristics

Several key characteristics define angel investors and set them apart from other types of investors:

Difference from other investors

Angel investors differ from other types of investors in several important ways:

Understanding the role and characteristics of angel investors is crucial for entrepreneurs seeking early-stage funding. These individuals not only provide much-needed capital but also bring valuable experience and connections to help startups navigate the challenging early stages of business development.

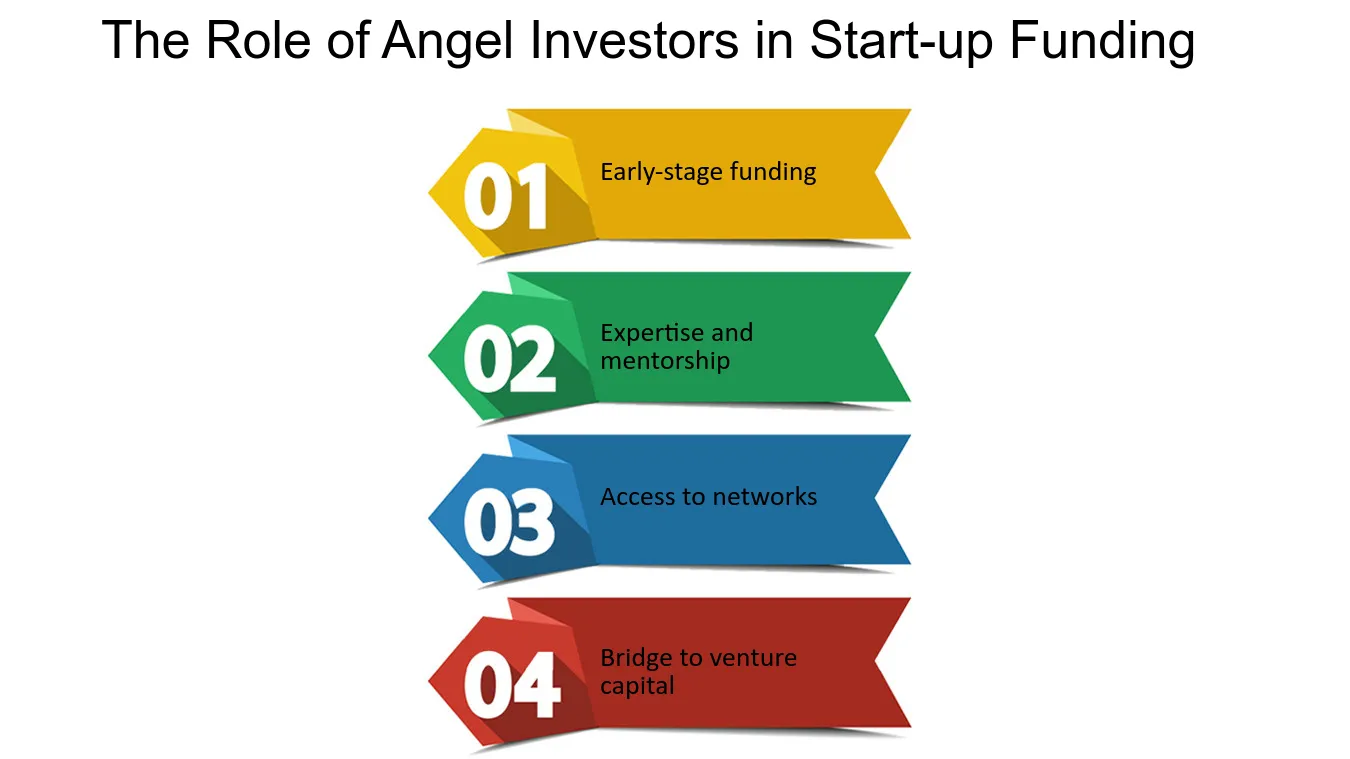

The Role of Angel Investors in Startup Ecosystems

Angel investors play a crucial role in fostering innovation and supporting early-stage startups. These individuals contribute significantly to the entrepreneurship ecosystem by providing seed capital, mentorship, and valuable network connections. Their involvement goes beyond financial support, as they actively participate in shaping the future of promising ventures.

Providing seed capital

One of the primary functions of angel investors is to offer seed money to startups in their initial stages. This financial support is often critical for entrepreneurs who may struggle to secure funding through traditional channels. Angel investors typically invest between INR 8,376,570 and INR 83.77 million in total, with individual investments ranging from INR 837,660 to INR 8,376,570. This capital injection allows startups to develop their products, conduct market research, and establish a foundation for growth.

Unlike venture capitalists who usually invest larger sums in more established companies, angel investors focus on early-stage businesses. They are willing to take calculated risks on innovative ideas and scalable business models, bridging the gap between seed funding and venture capital. By providing this crucial early-stage funding, angel investors help startups validate their concepts and achieve product-market fit.

Mentorship and guidance

Beyond financial support, angel investors offer invaluable mentorship and guidance to startup founders. Many angel investors are experienced entrepreneurs themselves, having successfully built and scaled businesses in the past. This wealth of experience allows them to provide strategic advice, help navigate challenges, and offer insights into industry trends.

Angel investors often take an active role in the startups they support, offering guidance on various aspects of business development. They may assist with refining business plans, developing marketing strategies, and making crucial decisions about product development. This mentorship is particularly valuable for first-time entrepreneurs who may lack the experience and knowledge needed to navigate the complexities of building a successful company.

The mentorship provided by angel investors goes beyond just business advice. They also help entrepreneurs develop their leadership skills and find their voice as leaders. Angel investors can teach startup founders how to deal with challenging situations that inevitably arise in the entrepreneurial journey. This personal growth aspect of the mentorship relationship is crucial for the long-term success of both the entrepreneur and the startup.

Network access

One of the most significant advantages angel investors bring to startups is access to their extensive networks. These networks often include other investors, industry experts, potential customers, and strategic partners. By leveraging these connections, startups can accelerate their growth and overcome obstacles more efficiently.

Angel investors can facilitate introductions to key players in the industry, helping startups form strategic partnerships or secure additional funding. They may also connect entrepreneurs with potential customers or clients, helping to jumpstart sales and revenue generation. This network effect can be particularly powerful in tech hubs like Silicon Valley, Tel Aviv, London, Paris, and Berlin, where angel investors are heavily concentrated.

The networking opportunities provided by angel investors extend beyond immediate business needs. They also contribute to the development of local startup ecosystems by fostering connections between entrepreneurs, investors, and other stakeholders. This collaborative environment encourages innovation and knowledge sharing, ultimately benefiting the entire entrepreneurial community.

In conclusion, angel investors serve as catalysts for innovation in the startup ecosystem. Their multifaceted role encompasses providing crucial seed capital, offering mentorship and guidance, and opening doors to valuable networks. By supporting visionary founders and groundbreaking ideas, angel investors contribute not only to the success of individual startups but also to the overall growth and competitiveness of the economy. Their involvement in the early stages of a startup’s journey often proves to be a defining factor in the company’s long-term success.

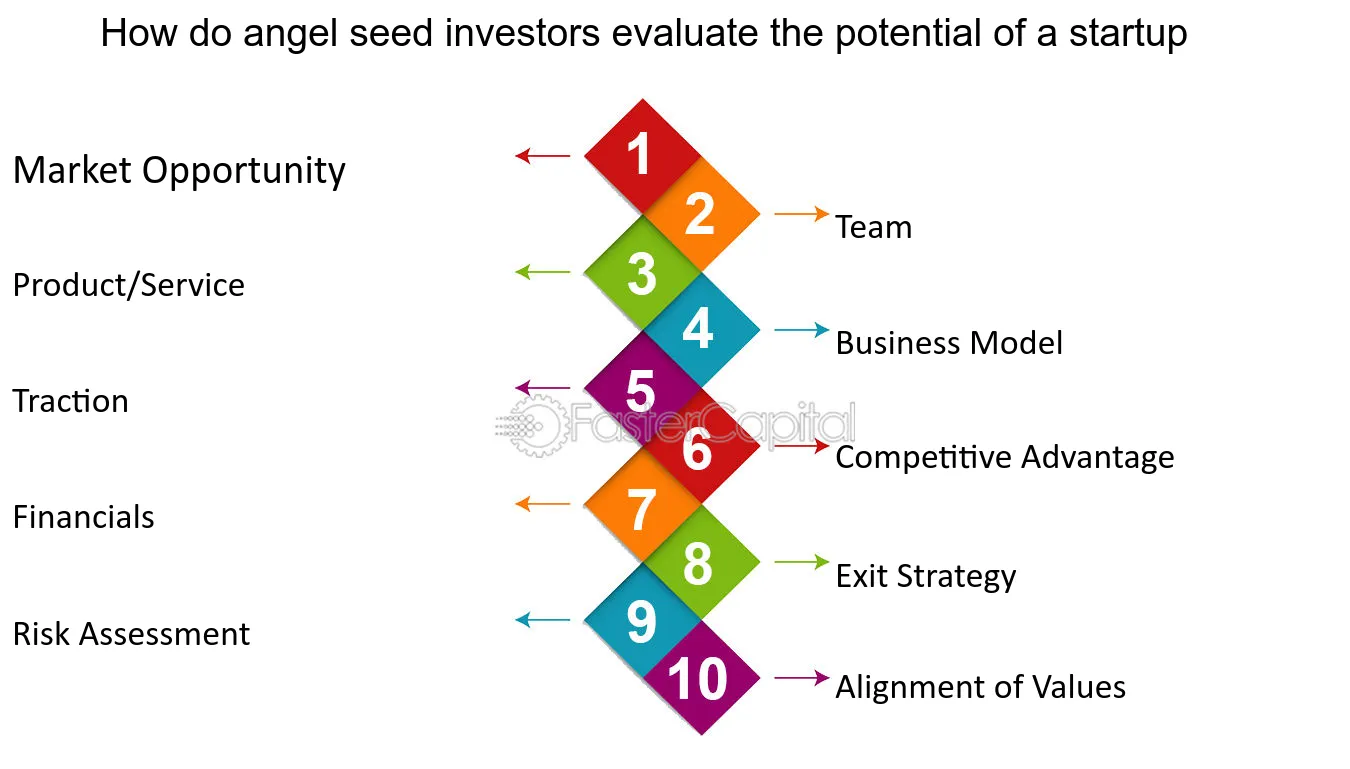

How Angel Investors Evaluate Startups

Angel investors play a crucial role in the startup ecosystem by providing early-stage funding to promising ventures. When evaluating potential investments, these investors employ a comprehensive approach to assess the viability and potential of startups. Their evaluation process typically focuses on three key areas: team assessment, market potential, and business model viability.

Team assessment

The management team is often considered the most critical factor in a startup’s success. Angel investors carefully examine the founding team’s capabilities, experience, and dynamics. They look for passionate and committed founders who have a deep understanding of their market and are prepared to go above and beyond to see their ideas through to completion.

Investors assess the team’s expertise, skills, and accomplishments in previous ventures to gage their potential for success with the current venture. They also evaluate the team’s ability to adapt to market changes and navigate challenges. Angel investors often conduct interviews with key team members to understand their level of commitment and determine if there are any functional gaps that need to be filled.

Reference checks are another crucial aspect of team assessment. Investors may use LinkedIn to find connections who have worked with the founders and can provide insights into their capabilities and character. This helps verify the claims made by entrepreneurs about their past roles and responsibilities.

Market potential

Analyzing the target market’s size and growth potential is a vital part of evaluating a possible investment. Angel investors favor startups operating in large and expanding markets, as this increases the likelihood of significant returns. They assess factors such as the addressable market size, growth rate, and competitive landscape.

Investors look for startups that can demonstrate a clear understanding of their target market and its potential for growth. They prefer companies operating in industries with substantial scalability and income potential. Angel investors also consider the competitive environment and identify any unique advantages or barriers to entry that the startup may have.

A common mistake entrepreneurs make is using the value of the target industry they are selling into, rather than the value of the product or service they are offering. Investors often ask entrepreneurs to walk them through their market sizing calculations to ensure they reflect solid thinking about existing products they are substituting and the breadth of product/market fit for a new product category.

Business model viability

The viability of a startup’s business model is crucial for angel investors. They evaluate factors such as revenue streams, profitability potential, and scalability. Investors look for startups that can demonstrate a clear strategy for growing their business and reaching a large market.

Angel investors assess the startup’s unique value proposition and how it sets them apart from competitors. They seek businesses that offer innovative concepts, products, or services that address real market needs. The ability to scale operations without a proportional increase in costs is also a key consideration for investors.

Traction and proof of concept are important indicators of business model viability. Even though early-stage startups may not have a fully developed product or a large customer base, angel investors look for signs of growth and market validation. This can include pilot programs, partnerships, or initial user feedback.

Financial projections and revenue models are scrutinized to ensure they are realistic and achievable. Investors evaluate the startup’s understanding of customer acquisition costs, lifetime value, and potential for recurring revenue. They also assess the company’s cash flow analysis and working capital requirements to ensure the business can sustain its projected growth rate.

By thoroughly evaluating these three key areas – team assessment, market potential, and business model viability – angel investors aim to identify promising startups with the potential for high returns. This comprehensive approach helps mitigate risks and increases the likelihood of successful investments in the dynamic world of entrepreneurship and startup funding.

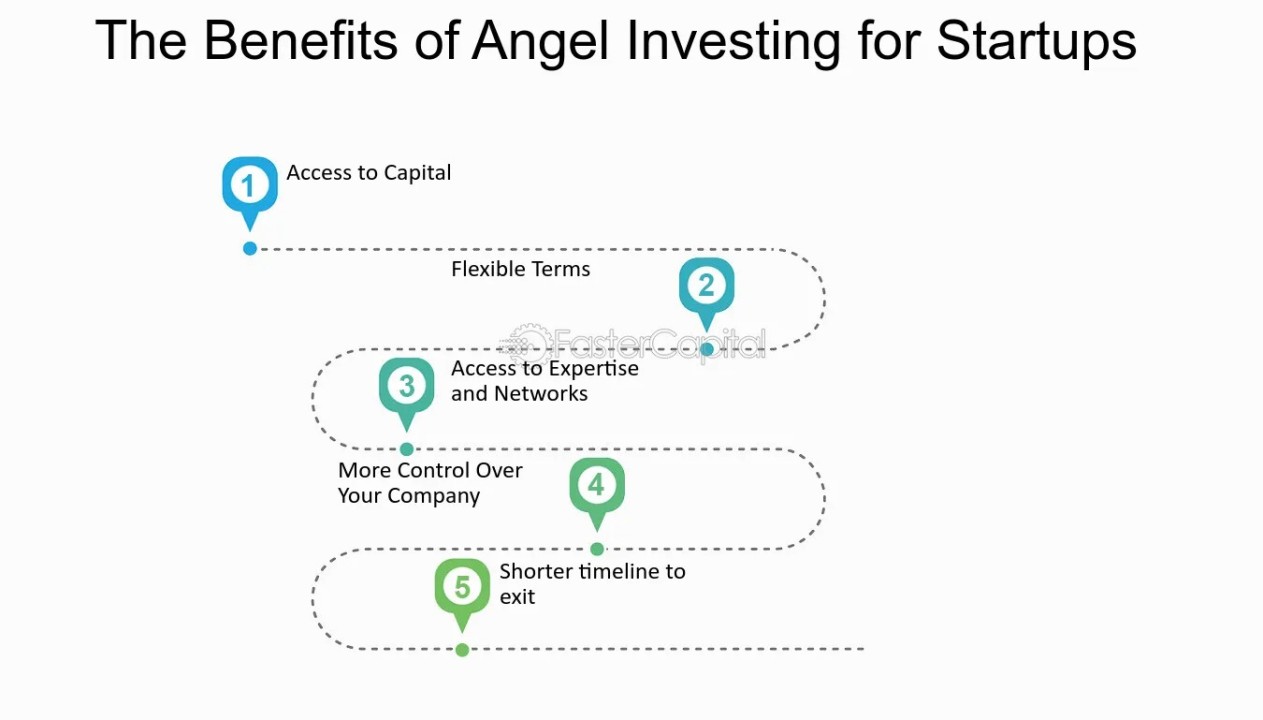

Benefits of Angel Investing for Startups

Angel investors offer numerous advantages to startups, providing more than just financial support. Their involvement can significantly impact a company’s growth and increase its chances of success. Let’s explore the key benefits of angel investing for startups.

Quick access to capital

One of the primary advantages of angel investing is the ability to secure funding quickly, especially for early-stage startups. Angel investors are often willing to take risks on new ventures when other forms of financing might be scarce or unavailable. This quick access to capital allows entrepreneurs to develop their products, reach their target market, or expand operations without the constraints of traditional funding sources.

Angel investors typically focus on startups in their initial stages, sometimes even before they generate revenue. This willingness to invest early makes angel funding an attractive option for entrepreneurs who may struggle to secure loans or other forms of financing. The capital provided by angel investors can be crucial for developing a minimum viable product, conducting market research, or covering initial operational costs.

Flexible terms

Unlike traditional lenders, angel investors often offer more flexible terms and are open to negotiation. This flexibility can be particularly beneficial for startups that may not have the financial history or collateral required by banks or other lending institutions. Angel investments typically involve acquiring an ownership share within the company as compensation for monetary funding, rather than requiring immediate repayment with interest.

One common form of angel investment is through convertible notes. These are initially debt instruments that have the potential to transform into company shares during subsequent capital raises. This structure allows for greater flexibility in valuation and can be advantageous for both the startup and the investor.

The level of involvement from angel investors can also vary based on the needs of the startup. Some may take a hands-off approach, while others might be more actively involved in mentoring and guiding the company’s growth. This flexibility allows entrepreneurs to tailor the relationship to best suit their business needs.

Value-added expertise

Perhaps one of the most significant benefits of angel investing is the value-added expertise that investors bring to the table. Many angel investors are successful entrepreneurs or industry veterans themselves, offering invaluable mentorship, advice, and industry insights. This expertise can be especially beneficial in the early stages of a startup’s development when guidance and support are crucial.

Angel investors can use their business and market expertise to support startups in making important decisions. They can help entrepreneurs tailor their business models, achieve deeper market penetration, and improve operational efficiency. This smart money, as it’s often called, is much more valuable than simple financial investment, as it combines capital with knowledge and experience.

Furthermore, angel investors often have extensive networks and can facilitate introductions to potential customers, partners, and future investors. This networking can be a key driver for early business development and growth. They can introduce startups to venture capitalists, credit institutions, and other investors, helping to raise additional capital for expansion.

The association with established angel investors can also enhance a startup’s credibility and visibility within the industry. This increased credibility can help attract talent, secure partnerships, and garner media attention, all of which are crucial for a startup’s growth and success.

In conclusion, angel investors provide startups with more than just financial support. They offer quick access to capital, flexible investment terms, and valuable expertise that can significantly accelerate a company’s growth trajectory. For entrepreneurs seeking not only funding but also guidance and industry connections, angel investing can be an ideal solution to fuel their startup’s success.

Challenges and Risks in Angel Investing

Angel investing, while potentially rewarding, comes with significant challenges and risks that investors must carefully consider. This section explores the main obstacles faced by angel investors in the startup ecosystem.

High failure rate

One of the primary risks in angel investing is the high failure rate of startups. Studies have shown that the failure rate in this asset class exceeds 50%. For instance, Tech Coast Angels reported that 32% of the companies and 68% of the outcomes failed to return the capital invested. This high failure rate underscores the inherent risk in early-stage investing and highlights the importance of diversification for angel investors.

Despite the high overall failure rate, it’s important to note that less than half a percent of failures were due to fraud. This suggests that while startup failures are common, they are typically due to market forces, execution challenges, or other business-related factors rather than fraudulent activities.

Lack of liquidity

Another significant challenge for angel investors is the lack of liquidity in their investments. Most investments in private companies are illiquid, meaning investors cannot simply sell their shares on a stock exchange. This illiquidity can tie up capital for extended periods, potentially impacting an investor’s overall financial strategy.

There are typically three ways for angel investors to achieve liquidity: secondaries, acquisitions, or initial public offerings (IPOs). However, these events can take years to materialize, if they occur at all. Even after an IPO, investors may face restrictions on selling their shares, such as lock-up periods or gradual sell-down requirements to avoid negatively impacting the company’s stock price.

The illiquid nature of angel investments means that investors must be prepared to commit their capital for the long term. This lack of liquidity can be particularly challenging for investors who may need access to their funds in the short to medium term.

Dilution concerns

Dilution is a significant concern for angel investors, particularly as startups go through multiple rounds of funding. Dilution refers to the decrease in percentage ownership that an investor has in a company due to the issuance of new shares of stock. This typically occurs when a startup raises additional capital by selling new shares to new investors or by issuing stock options to employees.

While dilution can be a sign of company growth and increased valuation, it can also decrease the value of an investor’s existing shares and reduce their potential return on investment. To mitigate the impact of dilution, angel investors can negotiate favorable terms, such as anti-dilution provisions, or stay involved in the company to maintain their ownership stake.

Understanding and managing these challenges and risks is crucial for success in angel investing. By adopting a diversified portfolio approach, being prepared for illiquidity, and actively managing dilution concerns, angel investors can navigate the complex landscape of early-stage investing more effectively.

Conclusion

Angel investors play a pivotal role in the startup ecosystem, providing not just capital but also valuable expertise and connections. Their willingness to take risks on early-stage ventures has an impact on innovation and entrepreneurship, bridging the gap between initial funding and larger investments. The benefits they bring to startups, including quick access to capital, flexible terms, and mentorship, can be game-changing for young companies trying to get off the ground.

However, angel investing comes with its own set of challenges, including high failure rates and concerns about liquidity and dilution. To navigate these risks, investors must approach each opportunity with careful consideration and a long-term perspective. Despite these hurdles, angel investing remains a crucial component of the startup funding landscape, fostering growth and innovation in the business world.

FAQs

What does early-stage startup funding entail?

Early-stage startup funding is the capital raised to support the development of a startup’s products or services. This funding is typically utilized for initial product development, marketing, and manufacturing.

Is it advisable to invest in early-stage startups?

Investing in early-stage startups can offer the potential for significant returns, often surpassing those of traditional investment types. However, it involves challenges, and Venture Capital (VC) funds often serve as intermediaries between investors and promising startups, helping to mitigate some of the risks involved.