Cryptocurrency trading has become increasingly popular, with investors seeking the best crypto exchange platforms to buy, sell, and trade digital assets. As the market evolves, choosing the right exchange is crucial for a seamless and secure trading experience. Factors such as trading fees, available cryptocurrencies, and user protection play a significant role in determining the top crypto exchanges.

In this article, we’ll explore the top crypto exchanges of 2024, highlighting key features to look for when selecting a platform. We’ll compare trading fees across different exchanges, examine advanced trading features, and discuss regulatory compliance measures. By the end, readers will have a comprehensive understanding of the best crypto trading platforms available, helping them make informed decisions in the dynamic world of cryptocurrency trading.

Top Crypto Exchanges of 2024

In the rapidly evolving world of cryptocurrency, several exchanges have emerged as leaders in the industry. These platforms offer a wide range of services, from basic buying and selling to advanced trading features. Let’s take a closer look at some of the best crypto exchanges of 2024.

Binance

Binance has established itself as the largest cryptocurrency exchange globally, boasting an impressive daily trading volume of over INR 6701.26 billion. With support for more than 600 cryptocurrencies, Binance offers traders a vast selection of digital assets to choose from. The platform is known for its low trading fees, starting at just 0.1%, making it an attractive option for both novice and experienced traders.

Binance provides a comprehensive suite of features, including futures and margin trading with high leverage, staking options through Binance Earn, and a Launchpad for new token offerings. However, it’s important to note that some of these features may not be available to users in certain jurisdictions, particularly in the United States.

Coinbase

Coinbase has gained popularity as one of the best crypto exchanges for beginners, thanks to its user-friendly interface and strong focus on security. The platform supports over 200 cryptocurrencies and has a daily trading volume exceeding INR 167.53 billion.

One of Coinbase’s standout features is its emphasis on regulatory compliance and user protection. The exchange insures digital funds held on behalf of users and stores U.S. dollar balances in FDIC-insured bank accounts. This commitment to security has made Coinbase a trusted name in the cryptocurrency industry.

Kraken

Kraken has built a reputation as a reliable and professional trading venue since its inception in 2011. The exchange offers a wide selection of over 250 cryptocurrencies and boasts a daily trading volume of more than INR 125.65 billion.

Kraken’s professional-grade trading platform, Kraken Pro, is particularly appealing to experienced traders. It provides customizable chart analysis tools, detailed order book insights, and high-speed execution. The exchange also offers competitive fees, with maker fees ranging from 0% to 0.16% and taker fees between 0.10% and 0.26%.

Crypto.com

Crypto.com has quickly established itself as a leading global crypto exchange, available in 90 countries and supporting over 350 cryptocurrencies. The platform stands out for its feature-rich mobile app, which offers a wide range of products and services, allowing users to trade, stake, and earn rewards on the go.

Gemini

Founded by the Winklevoss twins, Gemini has gained recognition for its strong emphasis on security and regulatory compliance. The exchange supports over 100 cryptocurrencies and has implemented robust security measures, including SOC 2 Type 2 certification and insurance for digital assets.

Gemini offers institutional-grade custody solutions and a feature called Gemini Earn, which allows users to earn interest on their cryptocurrency holdings. However, it’s worth noting that Gemini’s trading fees can be higher compared to some other exchanges, with web order fees potentially reaching up to 1.49% of the order value.

As the cryptocurrency market continues to evolve, these exchanges are likely to adapt and improve their offerings. When choosing the best crypto exchange for your needs, consider factors such as supported cryptocurrencies, trading fees, security measures, and available features. Always conduct thorough research and consider your individual trading goals before making a decision.

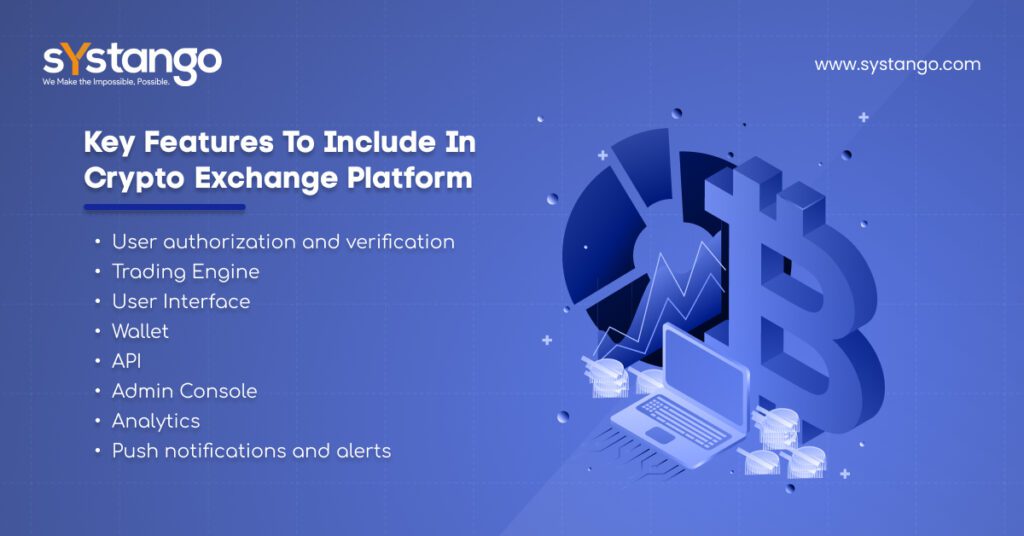

Key Features to Look for in a Crypto Exchange

When selecting the best crypto exchange for your needs, several key features should be considered. These features can significantly impact your trading experience and the security of your assets.

Security measures

Security should be a top priority when choosing a cryptocurrency exchange. Look for platforms that implement robust security features to protect your assets and personal information. The best crypto exchanges use advanced security measures such as two-factor authentication (2FA), encryption protocols, and cold storage for funds. Some exchanges also offer insurance policies to safeguard against potential losses due to security breaches. Additionally, consider exchanges that are SOC 2-certified, which means third-party auditors have verified their security and compliance frameworks.

Supported cryptocurrencies

A diverse selection of cryptocurrencies is crucial for traders who want to explore different investment opportunities. While Bitcoin and Ethereum are staples, access to a variety of altcoins allows you to diversify your portfolio and experiment with different assets. The best crypto trading platforms offer a broad range of coins, giving you the flexibility to tailor your investment strategy to your interests and goals.

Trading fees

Trading fees can significantly impact your overall profitability, especially for beginners who may make smaller trades more frequently. It’s essential to compare the fee structures of different exchanges, including maker-taker fees, withdrawal fees, and deposit fees. Lower fees can enhance your returns, but always weigh this against the security and services provided by the exchange. Some exchanges offer volume-based discounts, where fees decrease as trading volume increases.

User interface

A user-friendly interface is essential, particularly for beginners, as it makes the trading process more straightforward and less intimidating. Look for exchanges with clean, intuitive designs that offer clear instructions and easy navigation. A well-designed interface reduces the learning curve and allows beginners to focus on trading without getting overwhelmed by complex features.

Liquidity

Liquidity is a key factor as it affects how easily you can buy or sell cryptocurrencies without causing significant price changes. High liquidity means there’s a large volume of trades occurring on the platform, which leads to faster transactions and more stable prices. For beginners, choosing an exchange with high liquidity ensures that trades can be executed quickly and at predictable prices, making it easier to manage investments and avoid potential losses.

When selecting a crypto exchange, consider these key features to ensure a secure, user-friendly, and efficient trading experience. Remember that the best crypto exchange for you will depend on your individual needs, trading goals, and level of experience in the cryptocurrency market.

Comparing Trading Fees Across Exchanges

Understanding the fee structure of cryptocurrency exchanges is crucial for traders looking to maximize their profits. Different platforms employ various fee models, and it’s essential to compare them to find the best crypto exchange that suits your trading style and volume.

Maker and taker fees

Most cryptocurrency exchanges use a tiered maker-taker fee structure based on a trader’s 30-day trading volume. Makers are traders who add liquidity to the market by placing limit orders that aren’t immediately filled, while takers remove liquidity by placing market orders that are executed immediately.

Maker fees are generally lower than taker fees, as exchanges aim to incentivize liquidity provision. For example, Kraken Pro’s maker fees start at 0.25%, while taker fees begin at 0.40% for traders with 30-day volumes less than INR 837657.04. As trading volume increases, these fees can decrease significantly. Some exchanges even offer rebates for high-volume makers, further reducing trading costs.

Coinbase, another popular platform, charges maker and taker fees ranging from 0% to 0.60%, depending on trade volume. It’s worth noting that Coinbase recalculates the pricing tier hourly based on total trading volume, which can affect the fees you pay.

Deposit and withdrawal fees

In addition to trading fees, exchanges may charge for depositing and withdrawing funds. Many low-fee crypto exchanges offer free deposits for most cryptocurrencies and some fiat options. However, fees may apply for certain deposit methods or currencies.

Withdrawal fees can vary significantly between platforms and depend on the cryptocurrency being withdrawn. These fees often cover the blockchain transaction costs and may include additional charges from the exchange. For fiat currency withdrawals, fees can differ based on the withdrawal method:

- Bank transfers: Typically incur lower fees, especially for domestic transfers.

- Credit/debit cards and e-wallets: Generally more expensive, with fees ranging from 1% to 5%.

When comparing exchanges, it’s crucial to consider both trading fees and withdrawal fees, as some platforms may offer lower trading fees but have higher withdrawal fees.

Fee discounts

To reduce your crypto trading fees, many exchanges offer various discount programs:

When selecting the best crypto exchange for your needs, it’s essential to consider all these factors. While low fees are attractive, they should be balanced against other crucial aspects such as security, available cryptocurrencies, and regulatory compliance.

Remember that fee structures can change over time, so it’s wise to regularly review and compare the fees of different exchanges. By doing so, you can ensure that you’re getting the most value for your trades and maximizing your potential profits in the dynamic world of cryptocurrency trading.

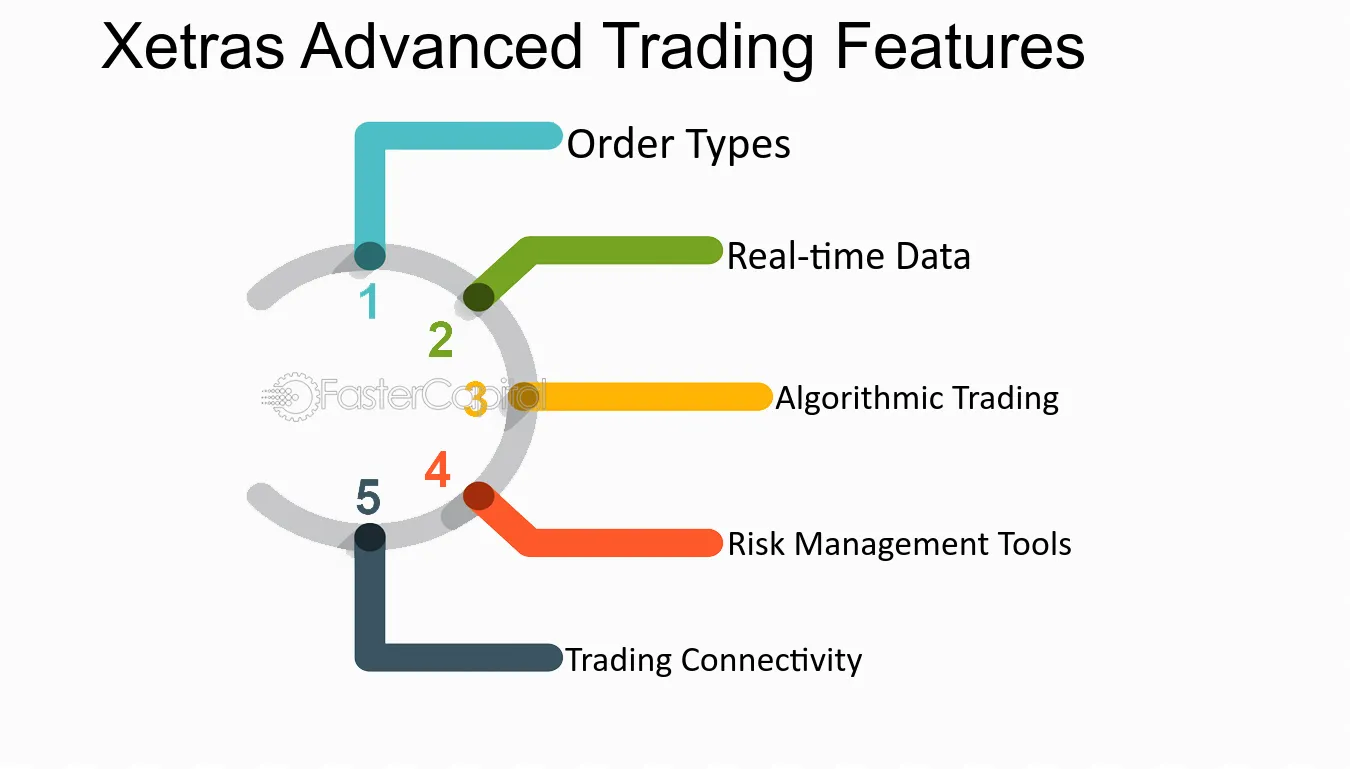

Advanced Trading Features

As cryptocurrency markets mature, advanced trading features have become increasingly important for experienced traders looking to maximize their profits. These features allow users to implement sophisticated strategies and manage risk more effectively. Let’s explore some of the key advanced trading features offered by the best crypto exchanges.

Margin trading

Margin trading allows traders to borrow funds to increase their buying power and potentially amplify their profits. This feature is particularly attractive to experienced traders who want to take advantage of short-term price movements. For example, Kraken, a well-established exchange, offers margin trading with up to 5x leverage on select cryptocurrencies.

When engaging in margin trading, it’s crucial to understand the risks involved. While it can magnify profits, it can also lead to significant losses if the market moves against your position. Traders should carefully consider their risk tolerance and use appropriate risk management strategies when utilizing margin trading.

Futures and options

Futures and options trading provide traders with additional tools to speculate on the future price of cryptocurrencies or hedge their existing positions. These derivative products allow users to take long or short positions on various cryptocurrencies without actually owning the underlying assets.

Delta Exchange, for instance, offers a wide range of futures and options contracts on popular cryptocurrencies like Bitcoin and Ethereum. The platform provides up to 100x leverage and settles all contracts in USDT, BTC, or ETH. This flexibility allows traders to implement complex strategies and potentially profit from both rising and falling markets.

One advantage of trading crypto options is the ability to speculate on future performance with limited downside risk. Call options give buyers the right to purchase a cryptocurrency at a predetermined price, while put options allow them to sell at a specific price. This can be particularly useful for managing risk in volatile market conditions.

Staking and lending

Staking and lending have emerged as popular ways for cryptocurrency holders to earn passive income on their digital assets. These features allow users to put their idle cryptocurrencies to work, generating returns without the need for active trading.

Staking involves participating in the network security of proof-of-stake blockchains by locking up tokens. In return, users receive rewards for helping to validate transactions and maintain the network. Many top crypto exchanges now offer staking services, making it easy for users to earn rewards on their holdings.

Crypto lending, on the other hand, involves loaning out digital assets to borrowers in exchange for interest payments. This can be done through centralized exchanges or decentralized lending platforms. For example, some exchanges operate systems where they lend out customer funds and share the interest among the customer base.

It’s important to note that while staking and lending can provide attractive returns, they also come with risks. These may include lockup periods, potential loss of funds due to platform hacks, or regulatory uncertainties. Users should carefully research the terms and conditions of these services before participating.

As the cryptocurrency market continues to evolve, advanced trading features are becoming increasingly sophisticated. From margin trading and derivatives to staking and lending, these tools offer experienced traders more ways to manage risk and potentially increase their returns. However, it’s crucial for users to understand the complexities and risks associated with these features before incorporating them into their trading strategies.

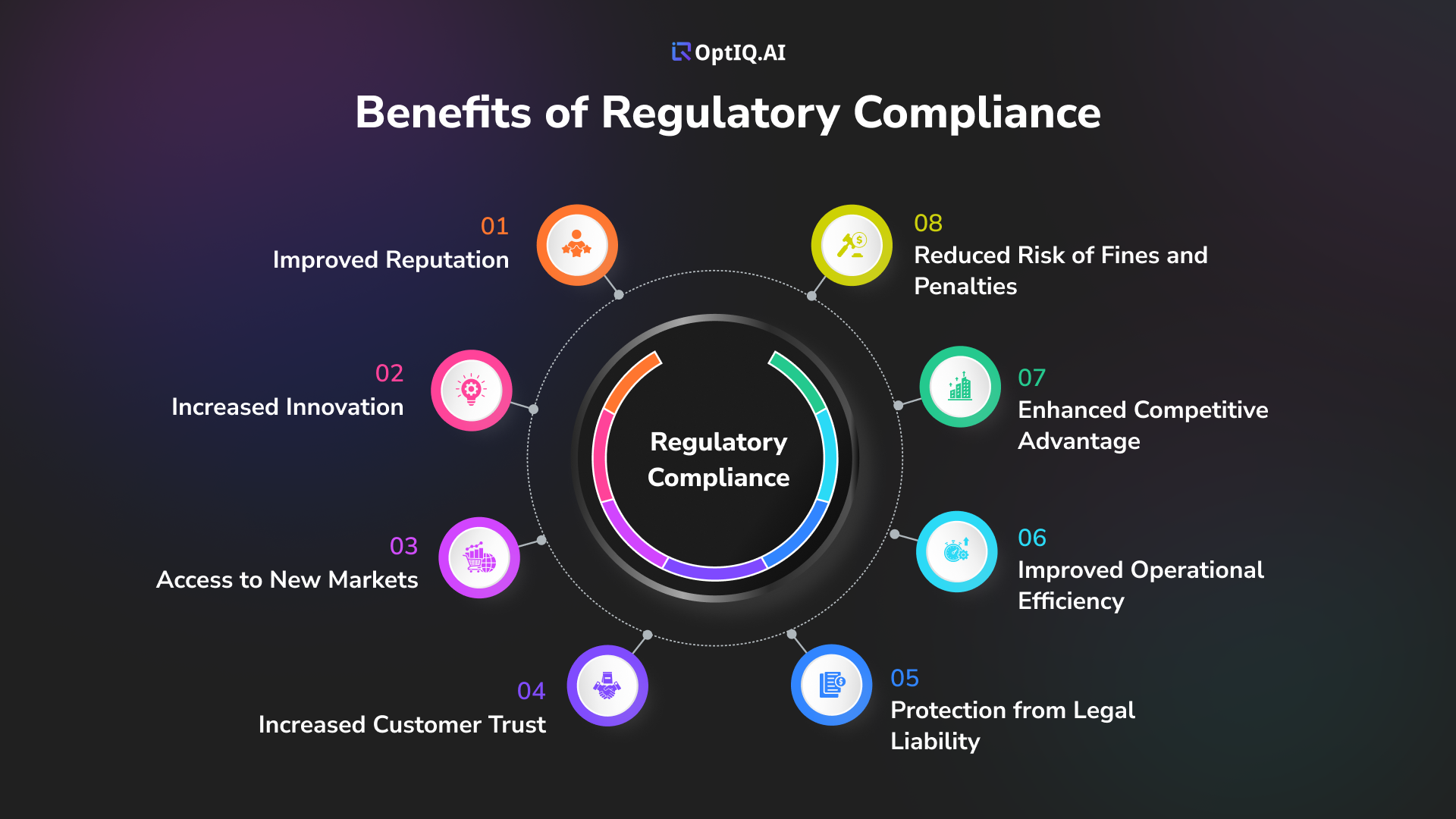

Regulatory Compliance and User Protection

As the cryptocurrency market continues to evolve, regulatory compliance and user protection have become crucial aspects for the best crypto exchanges. These measures are essential to ensure the safety of users’ assets and maintain the integrity of the cryptocurrency ecosystem.

Licensing and registration

To operate legally, cryptocurrency exchanges must obtain the necessary licenses and registrations in their respective jurisdictions. In many countries, crypto firms are required to register as Virtual Asset Service Providers (VASPs) with the appropriate regulatory bodies. For instance, in Lithuania, the process of obtaining a crypto license is relatively straightforward and aligns with some principles of the MiCA Directive.

In the United States, crypto exchanges are often classified as Money Service Businesses (MSBs) under federal regulations. This classification requires them to register with the Financial Crimes Enforcement Network (FinCEN) and comply with the Bank Secrecy Act (BSA). These regulations impose various obligations on exchanges, including record-keeping and reporting requirements.

Insurance coverage

As the cryptocurrency industry matures, insurance coverage has become an important consideration for exchanges and users alike. Some of the best crypto exchanges now offer insurance policies to protect users’ assets in case of security breaches or system failures. However, it’s important to note that most cryptocurrency insurance providers only offer services to institutions like exchanges, and policies typically do not cover individual consumers unless their cryptocurrency is involved in an exchange hack or failure of its systems.

For example, Gemini, a popular cryptocurrency exchange, maintains commercial crime insurance to cover breaches or failures of their systems or applications. This type of coverage provides an additional layer of protection for users’ assets stored on the platform.

KYC and AML policies

Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are critical components of regulatory compliance for cryptocurrency exchanges. These measures help prevent fraudulent activities, money laundering, and terrorist financing.

KYC procedures typically involve verifying the identity of users through various means, such as:

AML policies, on the other hand, focus on monitoring transactions and identifying suspicious activities. Exchanges are required to report any suspicious transactions to the relevant authorities and maintain detailed records of user activities.

Implementing robust KYC and AML policies is not only a legal requirement but also helps build trust among users. The best crypto exchanges prioritize these measures to ensure a secure trading environment and maintain compliance with regulatory standards.

It’s worth noting that compliance requirements can vary significantly between jurisdictions. For instance, in India, crypto firms must register with the Financial Intelligence Unit (FIU) and adhere to various provisions of the Prevention of Money Laundering Act. Failure to comply with these regulations can result in severe penalties and legal consequences.

As the cryptocurrency industry continues to mature, regulatory compliance and user protection measures will likely become even more stringent. Exchanges that prioritize these aspects and adapt to evolving regulations will be better positioned to succeed in the long term and provide a safer trading environment for their users.

Conclusion

The world of cryptocurrency trading has experienced significant growth, with various exchanges offering unique features and services to cater to different types of investors. From user-friendly interfaces for beginners to advanced trading options for experienced traders, these platforms have an influence on how people engage with digital assets. As the market continues to evolve, factors such as security measures, regulatory compliance, and fee structures play a crucial role in determining the best crypto exchanges.

To wrap up, choosing the right crypto exchange requires careful consideration of individual needs and trading goals. While low fees and a wide selection of cryptocurrencies are important, it’s equally crucial to prioritize security and regulatory compliance. As the crypto landscape continues to change, staying informed about the latest developments and adapting to new technologies will be key to success in this dynamic market.

FAQs

What are the top cryptocurrencies to invest in by 2024?

The leading cryptocurrencies to consider for investment in October 2024, expected to yield significant profits, include 5thScape (5SCAPE), Ethereum (ETH), Binance Coin (BNB), Polygon (POL), and USD Stablecoin (USDC).

Which exchange is recommended for trading cryptocurrency futures?

Kraken is highly recommended for cryptocurrency futures trading due to its strong security features and a wide range of available assets.

Which cryptocurrencies are expected to have a promising future in 2025?

For the year 2025, cryptocurrencies expected to experience substantial growth include EarthMeta, a metaverse platform, Cardano, Tokero, Shiba Inu, Moon Bag, Avalanche, EcoChain, and Uniswap.

What is the best platform for cryptocurrency trading in 2024?

According to NerdWallet’s 2024 rankings, the top platforms for cryptocurrency trading include Coinbase, ideal for beginners; Robinhood Crypto, suitable for traditional brokers; Gemini; Kraken; Crypto.com, known for its superior overall experience; Fidelity Crypto; and Interactive Brokers Crypto.