Tax season has major financial impact on both people and businesses. A qualified personal tax accountant’s expertise makes all the difference between basic returns and optimal tax benefits. Many people leave money on the table by missing valuable deductions and credits because they don’t have professional guidance through complex tax rules.

Professional tax services include key areas like income tax preparation, HMRC compliance, and strategic tax planning. The right accountant helps direct clients through trusts and complete accurate tax returns while spotting ways to save on taxes. This piece gets into what you should think over when picking a tax professional – from their credentials to how well they communicate and their availability.

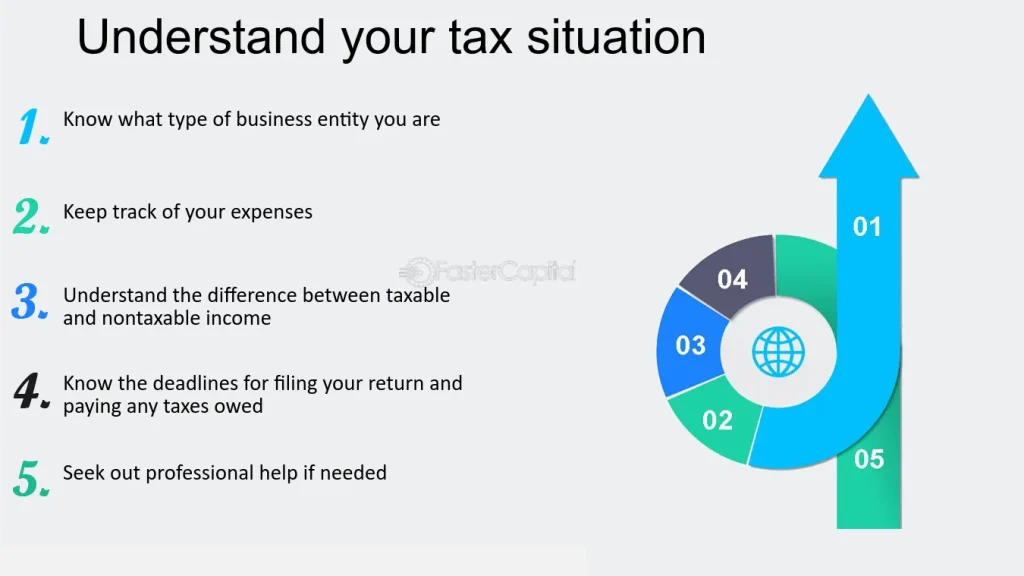

Understand Your Tax Needs

A detailed evaluation of one’s financial situation serves as the foundation to understand personal tax needs. Financial management affects both short-term monetary requirements and long-term retirement plans. This makes it significant to evaluate the financial situation with precision.

Assess your financial situation

Getting a full picture of your finances helps you understand your income sources and potential tax implications. Most personal tax accountants suggest you evaluate your current financial responsibilities and future goals. Here are the main areas to get into:

Identify complex tax issues

Tax matters can impact your finances both positively and negatively, and they need careful analysis. Complex tax situations emerge from various sources like multiple income streams, property ownership, and business interests. These complications become especially challenging when you have specialized areas such as trusts, international income, or business depreciation calculations.

Determine required services

Tax service needs vary by a lot based on your situation. Some people need simple tax preparation, while others need detailed services that include financial statement compilation, review, or audit. Industry-specific experience is a vital factor to think about when you choose a tax professional, especially when you have specialized sectors like construction or non-profit organizations.

You should evaluate if self-assessment works for you or if you need professional help. The tax department uses automated assessment systems that can spot differences between submitted returns and available information. Professional guidance proves valuable in complex situations.

Tax breaks and deductions change by a lot, and you need to understand them to maximize efficiency. The complex tax code leads many people to leave substantial money unclaimed. Professional guidance helps you get the most from your returns.

Research Qualifications and Expertise

You need to evaluate tax professionals’ credentials and expertise carefully before hiring them. All paid tax preparers must obtain a Preparer Tax Identification Number (PTIN) according to IRS rules, though this requirement is just the starting point.

Check credentials and certifications

Tax accountants need recognized certifications that prove their expertise. The most important credentials include Certified Public Accountant (CPA), Enrolled Agent (EA), or tax attorney status. These professionals must clear tough exams and complete continuing education requirements. The tax and accounting field shows positive changes in gender equality, with women earning 95% of what their male counterparts earn as of 2021. This shows a more balanced professional environment.

Look for specializations

Tax accounting includes several specialized areas that need specific expertise:

A professional’s deeper knowledge in specific areas shows through specialization. Many professionals pursue advanced degrees to improve their expertise. The Master of Accounting (MACC) degree with specialization creates many career opportunities.

Review years of experience

Most CPAs need at least 1,800-2,000 hours of professional experience to get certified. Tax accounting experts must keep detailed knowledge of all tax laws and regulations at local, state, and federal levels. The U.S. Bureau of Labor Statistics shows bright career prospects with 96,000 new jobs for accountants and auditors from 2020 to 2030.

Professional associations add credibility through their codes of ethics and professional conduct requirements. These organizations help clients find tax preparers who match their specific needs. Tax professionals who join these organizations show their steadfast dedication to continuous learning and industry standards.

Consider Reputation and Reviews

A tax professional’s reputation is a vital indicator of their reliability and service quality. Personal tax accountants should be evaluated through multiple feedback sources to get a complete view of their professional standing.

Read online testimonials

Online reviews help build trust and credibility for tax professionals. These testimonials improve search engine rankings and bring in more clients. Smart clients look at reviews on multiple platforms like Google, Yelp, and professional networking sites. A local tax professional with hundreds of five-star reviews deserves a closer look.

Ask for references

Getting personal referrals remains the quickest way to find qualified tax professionals. Your friends, colleagues, or business associates with similar tax situations can give an explanation about their experiences. Clients should follow these steps to check references:

Check professional associations

Professional organizations add credibility and provide excellent resources to find qualified tax professionals. The National Society of Accountants (NSA) helps tax and accounting small business owners and stays connected with members through multiple channels. Several other respected associations include:

These organizations excel at connecting businesses with firms that match their specific needs. Each member must meet strict professional standards and have recognized tertiary degrees. Professional associations also provide valuable member benefits and discounts that boost small practices’ bottom line.

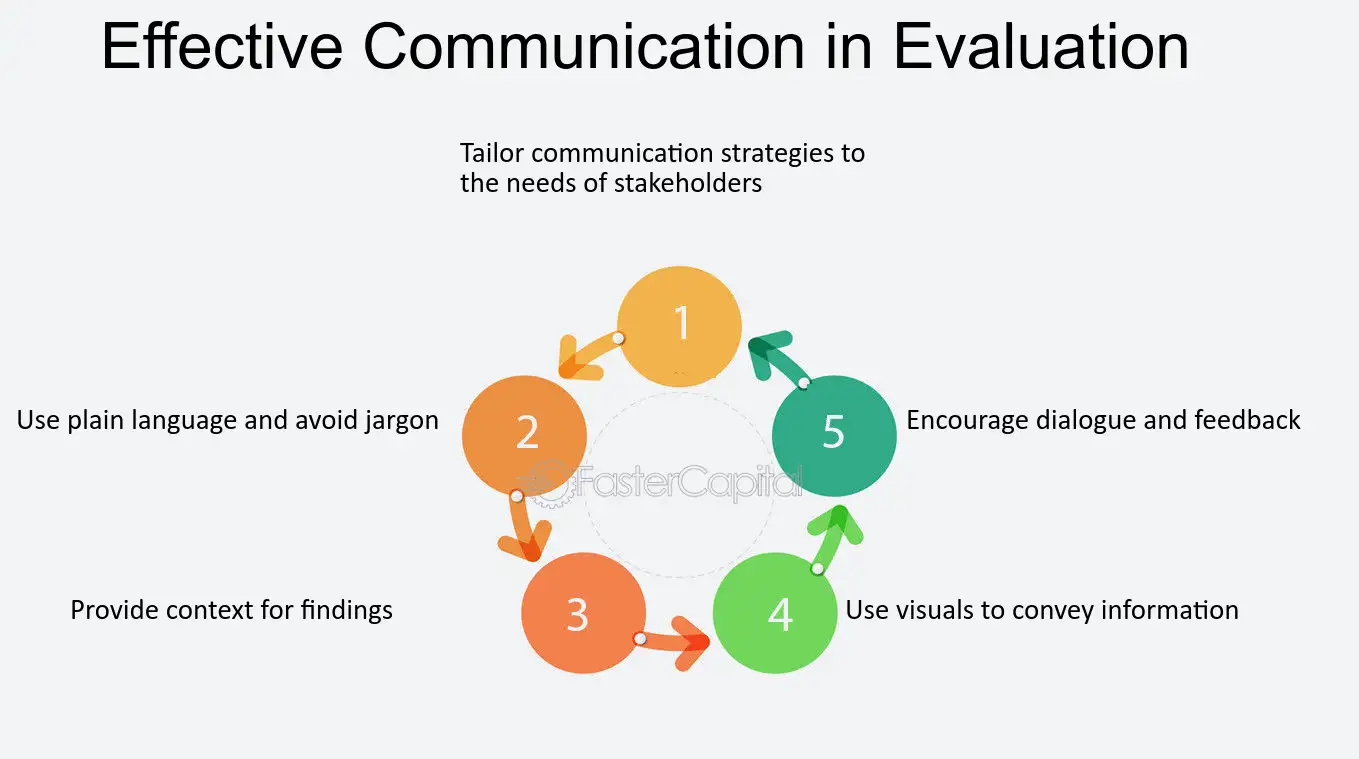

Evaluate Communication and Availability

Communication is the life-blood that drives successful relationships between clients and accountants in tax services. Studies reveal that 97% of employers rate communication skills as significant as technical expertise.

Assess responsiveness

Professional tax accountants must show prompt and consistent communication patterns. Research shows that clients switch accounting firms mainly due to poor responsiveness, especially when they have email correspondence issues. Clients should look at these key factors to evaluate potential tax professionals:

Understand their communication style

Tax professionals need clear communication to manage client expectations about timelines, deliverables, and fees. They must break down complex financial concepts into simple terms that clients understand. This skill matters because 89% of new employees fail within their first 18 months due to poor communication skills.

Successful tax accountants show these essential qualities:

Ask about availability during tax season

Tax season brings special challenges to accountant schedules. Many CPAs reach capacity and stop taking new clients during busy periods. Clients should know that tax accountants face the most important pressures at this time.

Tax professionals now work remotely through digital platforms. This setup can make clients expect them to be available all the time. But professionals need to set reasonable boundaries. Clients should discuss these key availability details:

Clear expectations from the start will give a smoother working relationship without misunderstandings. Talking early about schedules and workload management during tax season helps clients plan better and get the attention their tax matters need.

Conclusion

Choosing the right personal tax accountant depends on several key factors – professional credentials and how well they communicate with clients. Tax professionals with recognized certifications bring essential expertise and specialized knowledge to handle complex tax matters. Their thorough grasp of tax regulations and stellar reputation backed by positive client feedback ensures competent service and maximizes tax benefits.

Smart tax planning creates significant financial advantages over time. The best tax accountants build lasting professional relationships by staying accessible, maintaining open communication lines, and showing genuine care about their client’s financial well-being. Working with a reliable tax expert helps clients understand evolving tax laws while ensuring compliance and achieving the best financial results each year.