Key Highlights

Introduction

In the dynamic landscape of finance, understanding the intricacies of risk is paramount for maintaining financial health and financial stability. Two prominent types of risk, including the type of risk known as market risk and credit risk, demand close attention. This exploration aims to clarify the distinctions between these risks, providing valuable insights into their implications for investors and businesses alike. The risk of default associated with credit risk adds another layer of complexity to financial decision-making.

Exploring the Fundamentals of Market and Credit Risk

Navigating the financial world necessitates understanding the inherent risks involved. Market risk and credit risk are two fundamental types that significantly impact investment decisions and overall economic stability. These risks are intertwined yet distinct, influencing everything from individual portfolios to global financial systems.

While both are integral to financial assessments, their origins and implications differ drastically. Market risk stems from the unpredictable nature of financial markets, where factors like interest rates, commodity prices, and currency fluctuations can sway asset values. On the other hand, credit risk originates from the possibility of a borrower failing to meet their financial obligations, posing a threat to lenders and investors alike.

Defining Market Risk: A Comprehensive Overview

Market risk, also known as systematic risk, refers to the potential for investment losses due to factors affecting the overall performance of financial markets, including currency exchange rates. This inherent risk consists of both market risk and unsystematic risk, intertwined with the uncertainty of factors like interest rate risk, influenced by central bank policies and economic conditions. The stock market, a key indicator of economic health, plays a significant role in shaping market risk perceptions.

One of the most significant aspects of market risk is price volatility, which is closely related to standard deviation. Fluctuations in asset prices, driven by factors like news events, investor sentiment, and economic data releases, contribute significantly to market risk. Understanding the relationship between price volatility and various market factors is crucial for investors and businesses seeking to mitigate potential losses.

Moreover, market risk isn’t limited to a single asset class or geographical region. It permeates various markets, including equities, bonds, commodities, and currencies. This interconnectedness necessitates a holistic approach to risk management, considering the interplay between different asset classes and their sensitivity to market-wide events.

Understanding Credit Risk: Its Essence and Impact

Credit risk represents the possibility of a borrower or counterparty failing to fulfill their financial obligations as agreed, including their contractual obligations. This risk is particularly relevant for lenders, investors in debt securities, and businesses extending credit to customers. A key determinant of credit risk is the credit history of the borrower, reflecting their past repayment behavior and indicating their creditworthiness.

Furthermore, credit rating agencies play a vital role in assessing and assigning credit ratings to borrowers, reflecting their creditworthiness. These ratings serve as a benchmark for investors and lenders to evaluate the risk associated with lending to or investing in a particular entity.

Credit risk is inherently linked to the borrower’s ability to generate sufficient cash flow to meet their financial obligations. Factors like economic downturns, industry-specific challenges, or internal financial mismanagement can significantly impact a borrower’s cash flow and elevate credit risk.

Identifying the Key Differences Between Market Risk and Credit Risk

Although market risk and credit risk might appear similar at first glance, they have fundamental differences. Understanding these differences is crucial for investors and financial institutions to develop tailored risk mitigation strategies. It’s not enough to acknowledge their existence; a deeper understanding of their individual characteristics is paramount.

One of the most significant distinctions lies in the source of the risk. Market risk arises from external factors influencing the overall market, such as economic downturns or geopolitical events. In contrast, credit risk originates from the borrower’s financial capacity and willingness to repay their obligations. This difference highlights the need for diverse approaches when assessing and managing these risks.

The Nature of Market Volatility vs. Credit Solvency

Market risk is primarily driven by market volatility, which refers to the degree of fluctuation in asset prices. High market volatility translates to greater uncertainty and a higher probability of experiencing both substantial gains and losses. This inherent uncertainty makes it challenging to predict market movements accurately, even for seasoned investors, emphasizing the measure of market risk involved.

Credit risk, conversely, centers around the concept of credit solvency, which reflects a borrower’s ability to fulfill their debt obligations, including any potential debt issues. Assessing credit solvency involves analyzing the borrower’s financial standing, credit history, and overall risk profile, including the five Cs of credit. A borrower with a strong risk profile, evidenced by healthy financials and a track record of timely repayments, is considered more creditworthy and presents lower credit risk.

The distinction between market volatility and credit solvency highlights a fundamental difference in managing these risks. While diversification and hedging can help mitigate market risk, managing credit risk often involves thorough credit analysis, collateralization, and ongoing monitoring of the borrower’s financial health.

How Market and Credit Risks Affect Investments Differently

Understanding how market and credit risks uniquely impact investment portfolios is crucial for strategic asset allocation. Market risk can lead to broad-based declines in asset values, affecting an entire market or asset class. This highlights the importance of diversification, allocating investments across different asset classes to reduce the impact of a downturn in any specific market segment. The performance of investments can be significantly influenced by market fluctuations, underscoring the need for a well-defined investment strategy.

In contrast, credit risk primarily impacts investments in debt securities, such as bonds and loans that can provide high returns. A borrower’s default can result in principal and interest payment losses, directly affecting the performance of these investments. Therefore, managing credit risk often involves careful credit analysis, investing in higher-rated debt instruments, and potentially using credit derivatives to hedge against default risks.

Here’s how these risks affect different investment avenues:

The Role of Market Risk in Financial Markets

Market risk plays a pivotal role in shaping financial markets, influencing asset prices, investment decisions, and overall market dynamics. It’s the driving force behind market volatility, shaping investor sentiment and influencing how participants approach various asset classes.

A comprehensive understanding of market risk is crucial for investors to make informed decisions and manage their portfolios effectively. This includes analyzing their risk tolerance, investment goals, and the potential impact of market fluctuations on their investments.

Types of Market Risks: From Equity to Interest Rate Risk

Market risk manifests in various forms, each with its unique characteristics and impact on investments. Recognizing these different types of market risk is crucial for investors to develop a well-rounded risk management strategy.

Strategies for Managing Market Risk: Hedging and Diversification

Effectively managing market risk involves employing a combination of strategies designed to mitigate potential losses and enhance portfolio stability. Two prominent strategies in this domain are hedging and diversification.

Delving into Credit Risk: Types and Management

Credit risk, a critical aspect of financial assessments, demands a focused approach to understand its nuances and develop effective mitigation strategies. It’s not merely about avoiding borrowers perceived as high-risk; it’s about meticulously evaluating various dimensions of creditworthiness and implementing appropriate safeguards.

Managing credit risk effectively requires a multi-faceted approach. It begins with a thorough credit analysis, evaluating a borrower’s financial history, current financial health, and future prospects.

Categories of Credit Risk: Default, Concentration, and Counterparty

Credit risk can be categorized into distinct types based on its source and potential impact:

Techniques for Mitigating Credit Risk: Collateral and Credit Derivatives

Several effective techniques are employed to mitigate credit risk:

Measuring and Modeling Market and Credit Risks

In the realm of financial risk management, accurately measuring and modeling market and credit risks is paramount for making informed decisions. It involves using sophisticated methodologies and tools to quantify potential losses and assess the likelihood of their occurrence.

These quantitative assessments are crucial for financial institutions, investors, and regulators alike. They provide valuable insights into the risk exposure of portfolios, individual investments, and the overall financial system.

Tools for Assessing Market Risk: Value at Risk (VaR) and Stress Testing

Value at Risk (VaR), Monte Carlo simulation, and stress testing, along with sensitivity analysis, are essential tools for assessing market risk. VaR quantifies potential losses in investments based on Monte Carlo simulation statistical analysis, considering factors like interest rate fluctuations and price volatility. Stress testing, on the other hand, evaluates how portfolios would perform under extreme market conditions caused by events like natural disasters or geopolitical shifts. By utilizing these tools, financial institutions can gauge their exposure to market fluctuations and make informed decisions to manage market risk effectively.

Approaches to Credit Risk Evaluation: Credit Scoring and Portfolio Models

Evaluating credit risk effectively requires a combination of quantitative and qualitative assessments to gauge a borrower’s creditworthiness and the likelihood of default:

Regulatory Frameworks Governing Market and Credit Risks in India

India has implemented robust regulatory frameworks to govern market and credit risks within its financial system. The Reserve Bank of India (RBI), as the country’s central bank and financial regulator, plays a crucial role in setting prudential norms, supervising financial institutions, and ensuring the stability of the financial system. The evolving regulatory landscape reflects India’s commitment to fostering a resilient and well-regulated financial sector.

These frameworks aim to strengthen the financial system’s resilience, enhance transparency, and protect investors from excessive risk-taking. They also foster a culture of risk awareness and sound risk management practices among financial institutions.

Basel III and Its Influence on Market Risk Management

The Basel III framework, developed by the Basel Committee on Banking Supervision, significantly influences market risk management practices globally, including in India. Indian regulators have adopted and implemented key aspects of Basel III, enhancing the framework for measuring and managing market risk within the banking sector.

RBI Guidelines for Credit Risk Management

The RBI has established comprehensive guidelines for managing credit risk within the Indian financial system. These guidelines provide a framework for financial institutions to identify, measure, monitor, and control credit risk effectively. The RBI’s proactive approach to credit risk regulation helps maintain the stability and soundness of the Indian financial sector.

- RBI Guidelines: These guidelines cover various aspects of credit risk management, including credit appraisal, credit limits, provisioning for credit losses, and risk mitigation techniques. They emphasize a robust credit appraisal process, ensuring that financial institutions thoroughly assess the creditworthiness of borrowers before extending credit.

Conclusion

In conclusion, understanding the disparities between market risk and credit risk is crucial for making informed financial decisions. While market risk pertains to volatility, credit risk focuses on solvency. Diversification and hedging are pivotal strategies in managing these risks effectively. Regulatory frameworks like Basel III and RBI guidelines play a significant role in mitigating market and credit risks. By comprehending these differences and employing appropriate risk management techniques, investors can navigate the financial landscape with greater resilience and prudence. Stay informed, stay vigilant, and make strategic choices to safeguard your investments.

Frequently Asked Questions

What is the primary difference between market risk and credit risk?

The primary difference lies in the source. Market risk arises from the uncertainty of market price changes and movements, affecting all investments to varying degrees. On the other hand, credit risk is the risk that a borrower will fail to fulfill their credit obligations, resulting in potential financial loss for the lender.

How do diversification strategies differ for market and credit risks?

For market risk, diversification involves investing across various asset classes, sectors, and geographies to reduce exposure to any specific market downturn. In contrast, mitigating credit risk through diversification entails lending to a diverse pool of borrowers with varying risk profiles and minimizing exposure to a single borrower or industry. This strategy helps curb the potential for significant financial loss if a particular borrower defaults.

Can market risk and credit risk be effectively hedged in a portfolio?

Yes, both can be hedged, but the approaches differ. Hedging against market risk often involves using derivatives such as options or futures to offset potential losses from unfavorable price movements in underlying assets. For credit risk, hedging typically involves credit default swaps (CDS), where one party pays a premium to transfer the risk of default to another party. These instruments provide protection against potential losses from a borrower’s inability to meet their financial obligations.

What role do regulatory bodies play in managing these risks?

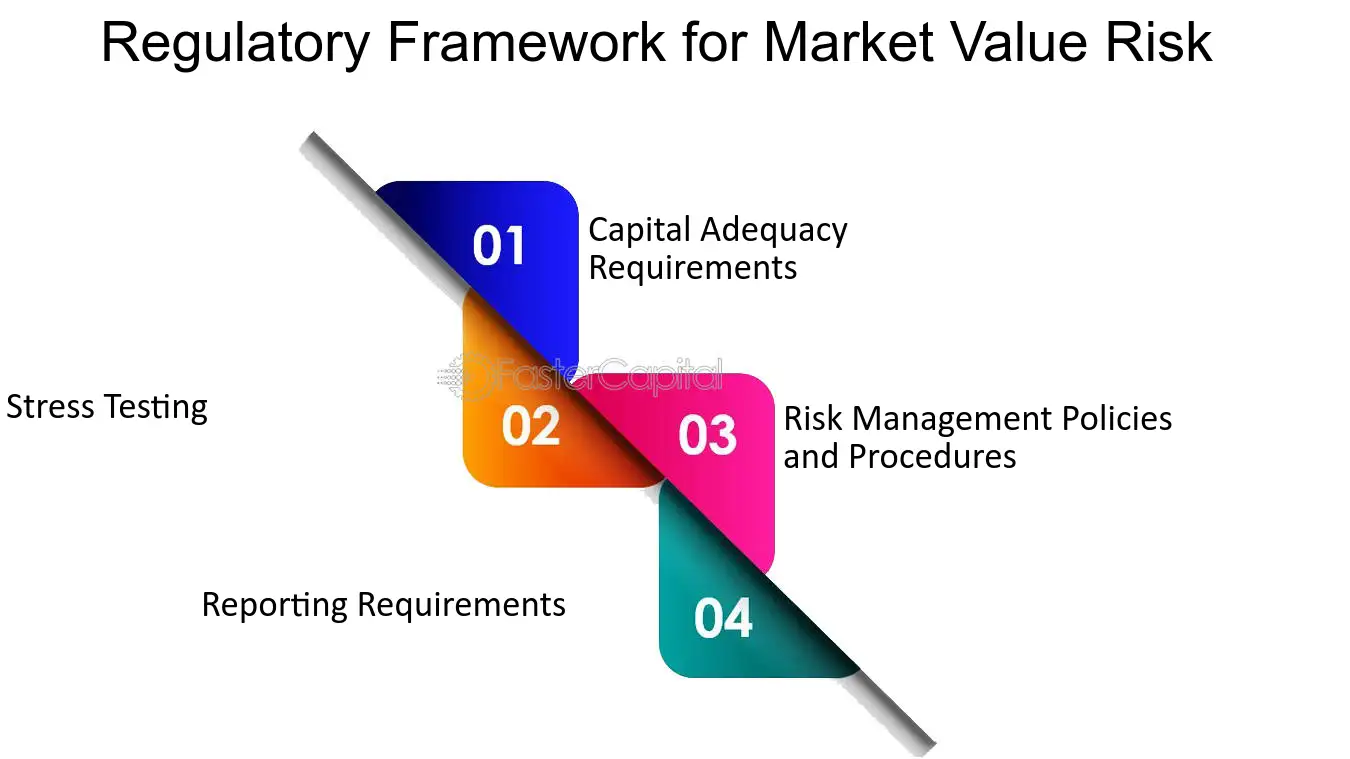

Regulatory bodies play a crucial role in mitigating both market and credit risks within the financial market. They establish guidelines and regulations for financial institutions, overseeing their compliance with capital adequacy requirements, risk management practices, and disclosure norms. By setting standards for risk assessment and management, these bodies strive to ensure the stability and soundness of the financial system as a whole, protecting stakeholders from excessive risk-taking and potential financial instability.

How has the financial landscape in India evolved in response to these risks?

India’s financial landscape has undergone significant transformation to address market and credit risks, driven by regulatory reforms, technological advancements, and growing investor awareness. The RBI, as the central banking institution, has played a pivotal role in implementing stricter norms for capital adequacy, risk management practices, and disclosure requirements for financial institutions, strengthening the overall financial health and resilience of the Indian market.

What is the difference between market risk and credit risk?

Market risk refers to the risk of losses due to movements in market factors like interest rates or stock prices. Credit risk, on the other hand, is the risk of loss from a borrower failing to repay a loan. Market risk is more about external factors while credit risk is specific to counterparties.