Today’s financial markets have become more complex, making professional portfolio management services a necessity for investors who want to maximize their returns. Portfolio management services (PMS) connect investors with seasoned professionals who use proven strategies and deep market expertise to manage investments actively. These services help investors direct their way through market ups and downs as they work toward their financial goals.

Let’s get into everything about portfolio management services – from types and benefits to selection criteria. You’ll learn about discretionary and non-discretionary PMS options, minimum investment requirements, and strategies that work for portfolio management. We’ll also cover what you should think over when choosing a PMS provider and how different fee structures affect your investment returns.

What are Portfolio Management Services?

Portfolio Management Services (PMS) offers a specialized investment solution that delivers tailored investment management if you have high net worth. The service creates custom investment portfolios that align with your financial goals, risk tolerance, and investment priorities.

Definition and key features

Portfolio Management Services are SEBI-regulated services that provide professional management of investment portfolios in asset classes of all types. PMS stands out with these distinctive features:

Types of PMS: Discretionary vs Non-Discretionary

Portfolio Management Services offers two distinct frameworks that determine how much control investors and managers have over investment decisions:

Discretionary PMS: Portfolio managers have full authority to make all investment decisions without asking clients. They manage the portfolio based on agreed investment strategies and can act quickly when market conditions change.

Non-Discretionary PMS: Clients play an active role in this approach. Portfolio managers suggest investment opportunities but need client approval before making any trades. This option works well for investors who want to retain control of their investments while getting professional advice.

Minimum investment requirements

SEBI’s minimum investment requirements for PMS participation have evolved significantly. PMS started with a ₹5 lakh threshold in 1993. The amount increased to ₹25 lakh and currently stands at ₹50 lakh since November 2019. This requirement helps PMS target sophisticated investors who understand risks and possess adequate financial capacity.

How Portfolio Management Services Work

Portfolio managers serve as trusted representatives who handle their client’s investments. These professionals follow a well-laid-out system that combines expert guidance with strategic decision-making. They manage investments based on their client’s specific goals and risk tolerance levels.

The role of portfolio managers

Portfolio managers act as trusted guardians of their clients’ investments while following strict regulatory guidelines. These financial experts must demonstrate their stability by maintaining a minimum net worth of ₹2 crore. Their essential duties include:

Asset allocation and diversification strategies

Asset allocation is the life-blood of portfolio management that enables managers to balance risk and returns effectively. Portfolio managers use static asset mixes in strategic asset allocation. These mixes stay within specific ranges – typically 65-75% equity and 25-35% debt. This disciplined investment approach helps investors avoid emotional decisions during market volatility.

Risk management becomes more effective through diversification. Investors spread their investments across different asset classes that show low or negative correlation. This strategy reduces portfolio volatility and enhances potential long-term returns.

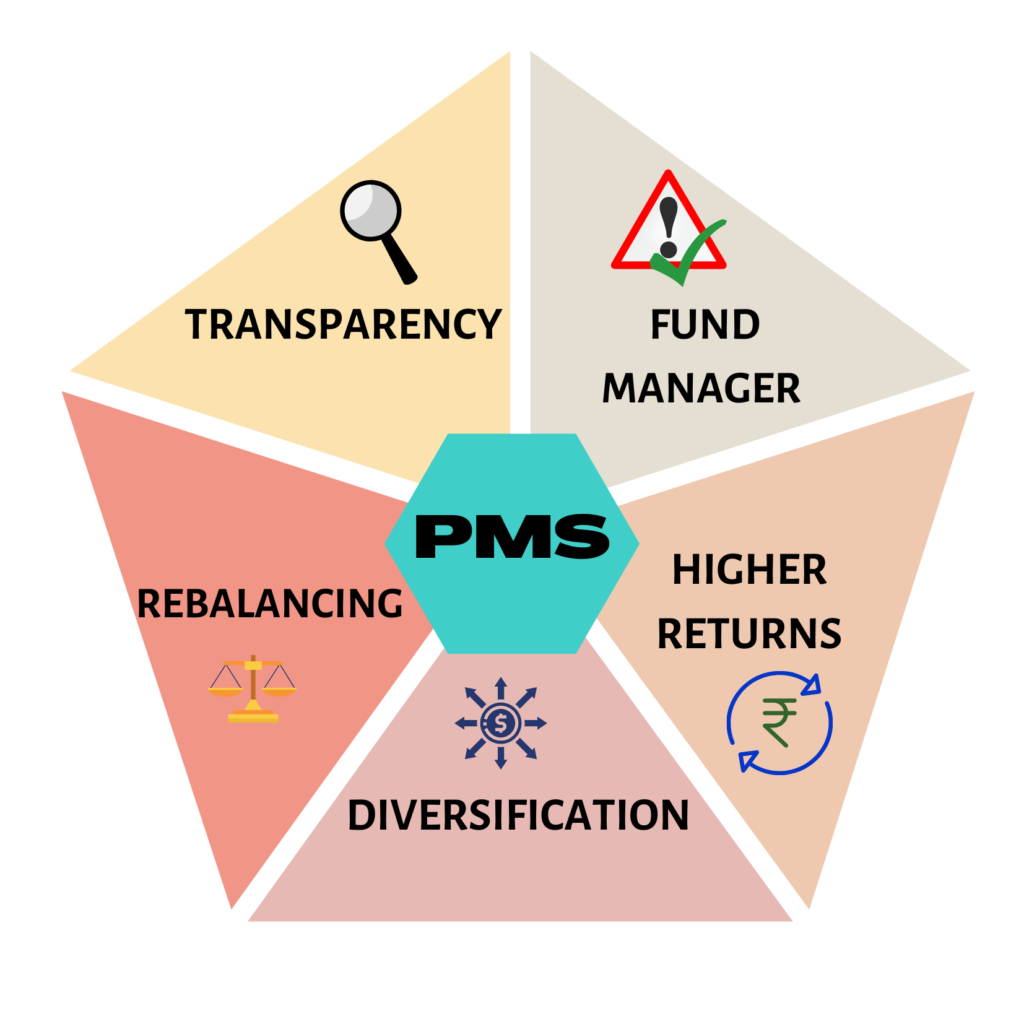

Monitoring and rebalancing portfolios

Portfolio monitoring requires regular assessment and adjustments to keep asset allocation at optimal levels. Investment managers review portfolios regularly and generate formal reports every six months. These reports include:

Market movements can push allocations away from their targets, which prompts managers to implement rebalancing strategies. Research shows that portfolios without rebalancing can experience substantially higher volatility levels. Managers sell overweight positions and strengthen underweight ones to maintain the desired asset mix and risk profile through the rebalancing process.

Benefits of Investing in PMS

Portfolio Management Services provide unique advantages if you have high net worth and need professional investment management. These complete benefits go beyond simple investment management and deliver value through specialized features.

Customized investment solutions

Portfolio Management Services creates investment strategies that match each investor’s unique needs. Our experts analyze the full picture of risk profiles, financial objectives, and investment horizons. PMS differs from standard investment products by building portfolios that arrange with investor requirements and evolve alongside their changing financial goals.

Professional management and expertise

Expert portfolio managers bring specialized knowledge and robust research capabilities to investment management. These professionals have deep market understanding that helps them use systematic methods to boost returns while reducing risks. They keep a watchful eye on investments and make smart adjustments based on market conditions and performance results.

Why PMS offers better returns

PMS showed remarkable performance when compared to traditional investment vehicles. Here are some impressive numbers that tell the story:

Transparency and regular reporting

PMS providers uphold high standards of transparency through detailed reporting systems. Portfolio managers deliver performance reports that include:

Strong regulatory frameworks will give strict compliance with disclosure requirements and give investors clear explanations about their investment management. This transparency makes informed decision-making possible and builds trust between investors and portfolio managers.

Choosing the Right PMS Provider

Investors must evaluate multiple factors beyond historical returns to select the right portfolio management service provider. The market has over 100 PMS providers, and investors need a systematic approach to make informed decisions.

Reviewing track record and performance

A complete performance analysis must look beyond recent results to understand consistency in different market conditions. The best way to review a track record involves breaking it into one-year, three-year, and five-year periods that show the provider’s true capabilities. This method helps identify providers who deliver stable performance instead of those who occasionally show exceptional results.

Understanding fee structures

PMS providers charge fees through multiple tiers that has:

Assessing risk management approaches

Risk management is the life-blood of successful portfolio management. Portfolio managers use strategies that handle different types of risks:

A provider must have reliable risk monitoring systems and regular reporting mechanisms. SEBI mandates monthly performance disclosures that ensure transparency in risk management practices.

Importance of lining up with investment goals

Investment providers should match their investment philosophy with the investor’s financial objectives. Several factors shape this selection:

The provider’s expertise and support systems are vital elements that lead to better decisions and quick responses to market changes. Personal meetings, conference calls, and written communications help maintain focus on investment objectives through consistent engagement.

Conclusion

Portfolio Management Services offer a refined investment approach that blends expert knowledge with individual-specific strategy implementation. These services add value through custom portfolio building, hands-on management, and complete risk monitoring systems. Professional portfolio managers utilize their market expertise and research skills that can lead to better returns while matching your investment goals and risk priorities.

The path to effective portfolio management starts with the right provider selection, fee structure evaluation, and performance history analysis. SEBI’s regulatory framework will give a protective shield through strict oversight and transparency rules. This makes PMS a dependable choice if you have substantial wealth and need professional investment guidance. Portfolio management services adapt continuously and give investors advanced tools and strategies to reach their long-term financial goals in challenging market conditions.